Free Credit History Check UK – Get Your Report Today

Free Credit History Check UK – Get Your Report Today

Your credit history plays a major role in shaping your financial opportunities. Whether you are applying for a mortgage, a personal loan, a credit card, or even a mobile phone contract, lenders will check your credit history before making a decision. Many people assume that accessing this information is complicated or costly, but in reality you can get your credit history report for free in the UK. Doing so not only helps you understand how lenders view you but also gives you the chance to correct errors and take control of your financial future.

What Is a Credit History Report?

A credit history report is a detailed record of your borrowing and repayment behaviour. It includes accounts such as credit cards, mortgages, loans, utilities, and even mobile phone agreements. Each entry shows whether payments were made on time, how much debt is outstanding, and whether there have been defaults or County Court Judgments (CCJs). The report is compiled by credit reference agencies, the main three in the UK being Experian, Equifax, and TransUnion check my credit score uk. Each agency collects slightly different data, so it’s possible that one report will show information another does not. That’s why many financial experts recommend checking all three to get the clearest picture of your credit profile.

Why Should You Check Your Credit History?

There are several benefits to checking your credit history regularly. The most obvious reason is awareness—knowing what lenders see helps you prepare before applying for new credit. If your report shows late payments or high utilisation of credit cards, you’ll understand why a lender might hesitate and can take steps to improve your record. Another key reason is fraud protection. Identity theft is on the rise, and fraudulent accounts could appear on your report without you realising it. By checking your credit history, you can quickly spot unfamiliar activity and raise a dispute. Regular checks also give peace of mind. Even if you aren’t planning to borrow, it feels reassuring to know that your financial information is correct and up to date.

How to Get Your Free Credit History Report in the UK

UK law allows you to request a free statutory credit report from each of the three credit reference agencies once every 12 months. Experian, Equifax, and TransUnion all offer simple online access. To get your report, you’ll need to create an account, provide your personal details, and verify your identity by answering security questions. In most cases you’ll have access instantly. Beyond the statutory reports, several platforms provide ongoing free access. ClearScore offers Equifax data and updates monthly, while Credit Karma uses TransUnion’s information and refreshes weekly. Experian also offers a free membership with a basic score and report. Many banks and credit card providers in the UK now include free access to your score and report within their online banking apps, making it even easier to keep track.

What to Look for in Your Report

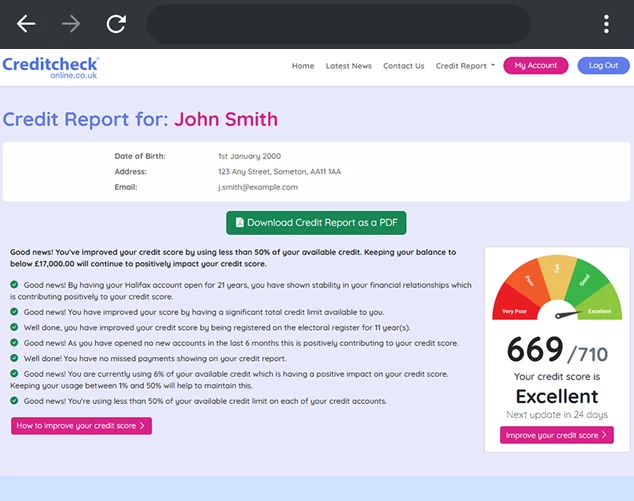

When you open your credit history report, take time to read it thoroughly. Check your personal details first to make sure your name, addresses, and date of birth are correct. Review each listed account to confirm it belongs to you and that the repayment history is accurate. Pay attention to missed payments, defaults, or CCJs, as these have the biggest negative impact. Look for recent hard searches, which are recorded when you apply for credit. Too many in a short period may lower your score. Finally, watch for accounts you don’t recognise, as these could be signs of fraud. If you find errors, you can raise a dispute with the credit reference agency and ask them to investigate.

Tips for Maintaining a Strong Credit History

Once you’ve checked your report credit history check uk, the next step is improving or maintaining a healthy record. Always pay bills and credit commitments on time, as payment history is the single most important factor. Keep your credit utilisation low, ideally under 30% of your available limit. Spread out credit applications and avoid applying for multiple products within a short space of time. Make sure you’re registered on the electoral roll, as this helps lenders confirm your identity. Keeping older accounts open, even if you don’t use them regularly, can also strengthen your profile by showing a longer credit history.

Final Thoughts

A free credit history check in the UK is not just a one-time task but an essential habit for anyone serious about managing their finances. It gives you insight into the information lenders rely on, helps you spot fraud, and empowers you to make changes that improve your financial future. With Experian, Equifax, and TransUnion all offering free access, along with platforms such as ClearScore and Credit Karma, there has never been an easier time to get your report. Don’t wait until you are declined for credit to find out what’s on your file—get your free report today and stay one step ahead.