Food Grade Magnesium Derivatives Market Growth Sustained by Food Processing

The food grade magnesium derivatives market continues to grow steadily, supported by rising demand from the food & beverage sector and increased use in multiple applications.

The global food grade magnesium derivatives market size was valued at USD 874.3 million in 2022 and is expected to reach USD 1.24 billion by 2030, expanding at a CAGR of 4.5% from 2023 to 2030. Rising demand from the food & beverages sector is a key growth driver, where magnesium derivatives are used as anti-caking, flavoring, firming, color-retention, and brewing agents.

Popular magnesium derivatives include magnesium chloride, oxide, lactate, gluconate, hydroxide, stearate, and citrate, with magnesium oxide being the most widely adopted due to its non-toxic and non-flammable properties. The prices of organic derivatives are increasing, driven by higher raw material costs and surging demand in the F&B industry, particularly in developed economies. Limited production capacity of organic derivatives, coupled with rising use in confectionery and beverages, has further pushed their prices upward.

Magnesium derivatives such as magnesium chloride, lactate, citrate, and stearate are gaining strong traction owing to their ease of application and availability. However, health risks associated with overconsumption may restrict growth. Excessive intake can lead to nausea, diarrhea, and even severe health conditions such as diabetes and heart disease, according to safety data from Santa Cruz Biotechnology, Inc. Individuals with intestinal, kidney, or heart conditions are advised to avoid consumption without medical consultation.

The recent European geopolitical conflict further impacted the industry by driving up oil and energy costs, raising production expenses, and disrupting raw material trade flows. While this affected chemical markets across regions, the food-grade magnesium derivatives sector faced minimal impact, as annual trade in food additives remained largely stable.

Key Market Trends & Insights

- North America accounted for the largest revenue share of 33.8% in 2022.

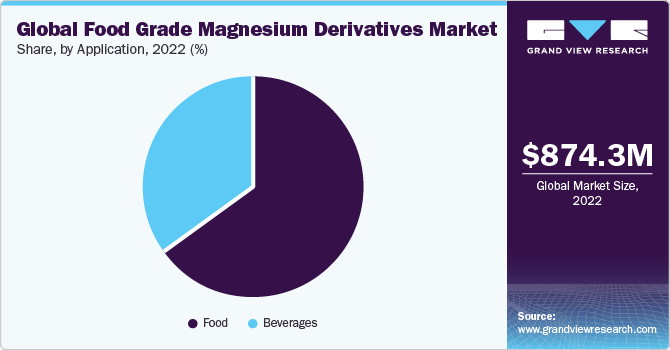

- By application, the food segment dominated with a 65.3% revenue share in 2022.

- By product, the inorganic segment led with a 55.5% revenue share in 2022.

Download a free sample PDF of the Food Grade Magnesium Derivatives Market Intelligence Study, published by Grand View Research.

Market Performance

- 2022 Market Size: USD 874.3 Million

- 2030 Projected Market Size: USD 1.24 Billion

- CAGR (2023–2030): 4.5%

- North America: Largest market in 2022

Competitive Landscape

The industry is moderately consolidated, with competition influenced by product mix, seller presence, and geographic reach. A few established players hold significant market share, with strategies focused on product innovation, capacity expansion, geographic penetration, and strategic partnerships or acquisitions.

For instance, in August 2021, NikoMag expanded its production capacity of magnesium hydroxide from 25,000 tons/year to 40,000 tons/year, reinforcing quality standards and strengthening its position in the global market.

Key Companies

- Grecian Magnesite

- Sinwon Beverages Co., Ltd.

- Compass Minerals

- OLE Chemical Co., Ltd.

- Martin Marietta Magnesia Specialties

- Ibar Northeast

- NikoMag

- K + S Aktiengesellschaft

- Oksihim, Ltd.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The food grade magnesium derivatives market continues to grow steadily, supported by rising demand from the food & beverage sector and increased use in multiple applications. While supply-side challenges and health concerns may temper growth, ongoing product innovations and capacity expansions are set to sustain long-term market momentum.