Fill-finish Pharmaceutical Contract Manufacturing Market 2030 Segment Insights

The fill-finish pharmaceutical contract manufacturing market is poised for steady and sustained growth through 2030, supported by the increasing complexity of biologics, rising demand for outsourcing, and ongoing regulatory modernization.

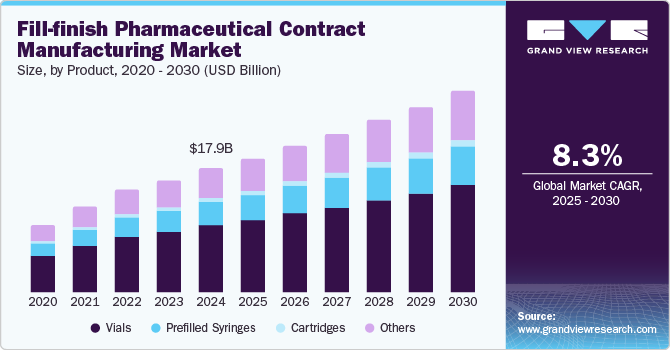

The global fill-finish pharmaceutical contract manufacturing market was valued at USD 17.95 billion in 2024 and is projected to reach USD 29.06 billion by 2030, expanding at a CAGR of 8.3% from 2025 to 2030. A major trend driving this growth is the increasing outsourcing of fill-finish operations by pharmaceutical companies.

By outsourcing these specialized processes to contract manufacturing organizations (CMOs), pharmaceutical firms can focus on their core areas—such as drug discovery and development—while mitigating operational risks and reducing capital investment. This strategy enables companies to enhance efficiency and competitiveness in an evolving market landscape.

Technological advancements in fill-finish manufacturing are further transforming the industry by improving process precision, efficiency, and compliance with global regulatory standards. For instance, in June 2024, Lonza introduced the Capsugel Enprotect size 9 capsule to streamline pre-clinical testing of acid-sensitive APIs in rodents, accelerating drug development timelines. Additionally, regulatory agencies such as the NMPA (China) and ANMAT (Argentina) are expediting approval processes, strengthening overall market dynamics.

The rapid growth of biologics, including monoclonal antibodies and vaccines, is also fueling demand for specialized fill-finish services capable of managing high-volume and high-potency products. Collaborative initiatives between local pharmaceutical companies and international CMOs are increasingly vital to meeting this demand, particularly in emerging markets like Saudi Arabia and India, where public healthcare investments are surging.

For example, in June 2023, Saudi Arabia’s Public Investment Fund launched Lifera, a CDMO aimed at expanding local biopharmaceutical manufacturing capacity and ensuring medicine supply security in alignment with Vision 2030. Strategic alliances and regulatory reforms such as these are expected to foster innovation, efficiency, and sustained growth in the global fill-finish pharmaceutical contract manufacturing market.

Key Market Trends & Insights

- North America dominated the global market with a 34.9% revenue share in 2024.

- The U.S. accounted for 88.3% of North America’s market share in 2024.

- By molecule type, the large molecules segment led with a 67.3% revenue share in 2024.

- By end-use, biopharmaceutical companies held the largest share at 55.3% in 2024.

- By product, vials dominated the market, accounting for 53.4% of global revenue in 2024.

Download a free sample PDF of the Fill-Finish Pharmaceutical Contract Manufacturing Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 17.95 Billion

- 2030 Projected Market Size: USD 29.06 Billion

- CAGR (2025–2030): 8.3%

- Largest Market (2024): North America

- Fastest-Growing Market: Asia Pacific

Competitive Landscape

Leading market participants are pursuing capacity expansion, technology integration, and strategic collaborations to meet the increasing demand for injectable drugs and biologics. These initiatives aim to improve operational flexibility, scalability, and service quality.

For instance, in November 2024, Lonza’s Synaffix licensed its ADC technology to BigHat Biosciences, integrating it with BigHat’s ML platform to develop a new pipeline of antibody-drug conjugates.

- Boehringer Ingelheim offers end-to-end solutions encompassing aseptic filling, lyophilization, and packaging for vials and prefilled syringes, leveraging a global network for enhanced capacity and flexibility.

- Eurofins Scientific provides analytical testing and biopharmaceutical development services, ensuring product quality, safety, and regulatory compliance across the supply chain.

Prominent Companies Include:

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Boehringer Ingelheim International GmbH

- Catalent, Inc. (acquired by Novo Holdings A/S)

- Societal CDMO (Recro Pharma, Inc.)

- Baxter

- Eurofins Scientific

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The fill-finish pharmaceutical contract manufacturing market is poised for steady and sustained growth through 2030, supported by the increasing complexity of biologics, rising demand for outsourcing, and ongoing regulatory modernization. Strategic collaborations, technological advancements, and growing healthcare investments across emerging markets are expected to further enhance manufacturing efficiency, reliability, and innovation within this rapidly evolving sector.