Europe Dairy Alternatives Market Insights into Cheese Alternatives Segment

The Europe dairy alternatives market is experiencing robust growth, driven by health-conscious consumers, innovation in plant-based formulations, and rising cases of lactose intolerance.

The Europe dairy alternatives market size was valued at USD 5.52 billion in 2023 and is projected to reach USD 11.71 billion by 2030, expanding at a CAGR of 11.4% from 2024 to 2030. Growth in the market is driven by the rising demand for healthier food and beverage options across the region. Dairy-alternative beverages are increasingly consumed as substitutes for traditional dairy products, with manufacturers focusing on innovation—such as soya juice blends and fresh soya-based drinks.

Europe accounted for 18.9% of the global dairy alternatives market revenue in 2023. Among product types, almond milk is expected to witness the fastest growth, supported by organic-positioned product launches from leading brands such as Earth’s Own Food Company and Blue Diamond Growers. To attract consumers, producers are introducing dairy substitute beverages in multiple flavors, including vanilla, chocolate, and honey.

The use of dairy alternatives in food applications such as cheese, desserts, and snacks is also projected to support market growth over the forecast period. Non-dairy ice creams—particularly coconut and almond-based—are gaining popularity in the region. In addition, increasing demand for lactose-free yogurt drinks and dairy-free cheese (slices, blocks, shreds) as well as butter and creamers is expected to further fuel industry expansion.

Growing consumer awareness of nutrition, combined with rising preference for products with lower fat and cholesterol content, is opening new opportunities for market participants. Furthermore, widespread lactose intolerance remains a major driver for adoption—according to the World Health Organization, over 60% of the global population has some degree of milk allergy or intolerance.

Key Market Insights:

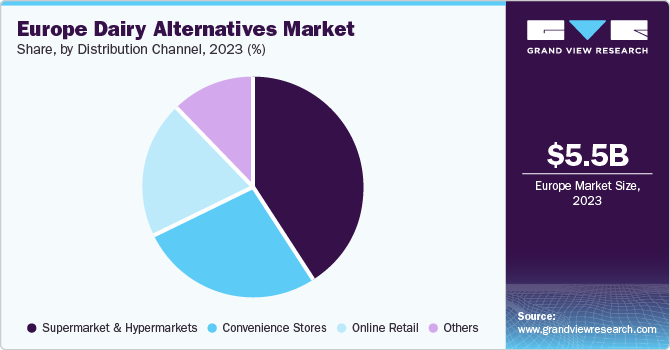

- By distribution channel: Supermarkets & hypermarkets dominated the market with over 41% revenue share in 2023.

- By source: Soy-based dairy alternatives held a revenue share of over 35% in 2023, driven by rising cases of lactose intolerance and milk allergies in the region.

- By product: Non-dairy milk led the market in 2023 with a revenue share of more than 66%, supported by growing adoption among Europe’s aging population.

Order a free sample PDF of the Europe Dairy Alternatives Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2023 Market Size: USD 5.52 Billion

- 2030 Projected Market Size: USD 11.71 Billion

- CAGR (2024–2030): 11.4%

Key Companies & Market Share Insights

The European dairy alternatives market is highly competitive, with the presence of several internationally recognized brands. Companies are actively focusing on new product launches to strengthen their market share. For example, in November 2021, Oatly introduced its Oat Drink Vanilla Flavor in the U.K., made with rapeseed and fortified with vitamins B12 and D2, catering to the growing demand for plant-based beverages.

Key Players

- Blue Diamond Growers

- Danone S.A.

- Melt Organic

- Ecomil

- Ecotone

- First Grade International Limited

- Oatly Group AB

- The Hain Celestial Group Inc.

- Upfield Holdings BV

- Unilever PLC

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The Europe dairy alternatives market is experiencing robust growth, driven by health-conscious consumers, innovation in plant-based formulations, and rising cases of lactose intolerance. With increasing product diversification, expanding retail presence, and strong brand activity, the region is set to remain one of the most dynamic markets for dairy alternatives globally.