Europe Cosmetics Market Driven by Demand for Personalized Beauty Products

The Europe cosmetics market is poised for steady expansion, supported by growing consumer awareness, product innovation, and shifting beauty standards.

The Europe cosmetics market size was estimated at USD 60.97 billion in 2023 and is projected to reach USD 87.19 billion by 2030, growing at a CAGR of 5.3% from 2024 to 2030. Growth in this market is driven by increasing awareness of skincare and personal care routines, the rising number of companies in self-care and hygiene, and strategic initiatives by industry leaders to expand product offerings. Enhanced access to consumer data has further enabled the development of products tailored to diverse needs and preferences.

Additional growth drivers include higher disposable incomes, rising demand for personal hygiene products, adoption of affordable cosmetics, and growing use of skincare to address dermatological concerns. In 2023, Europe accounted for 20.6% of global cosmetics market revenue. Stressful lifestyles and busy schedules have also encouraged consumers to adopt personal care rituals, while millennials, highly influenced by social media, peer trends, and brand value, are significantly boosting demand.

Digital engagement and influencer-driven campaigns are central to marketing strategies, helping brands capture attention, generate demand, and identify gaps for innovation. Market leaders are increasingly investing in acquisitions and product innovation. For instance, in September 2022, Shiseido Europe S.A. acquired Gallinée Ltd. to strengthen its portfolio.

Another major trend shaping the market is the rising adoption of cosmetics by men. The expansion of men’s grooming products—including skincare, haircare, beard care, and hygiene—reflects shifting gender norms. Companies are leveraging male brand ambassadors, gender-neutral packaging, and competitive pricing strategies to capture this demand. Social media, influencer content, and online tutorials further amplify growth in this segment.

Key Market Insights

- By End-user: Women accounted for the largest share of 63.64% in 2023.

- By Distribution Channel: The offline segment held a dominant share of 72.78% in 2023, supported by the widespread physical availability of cosmetics.

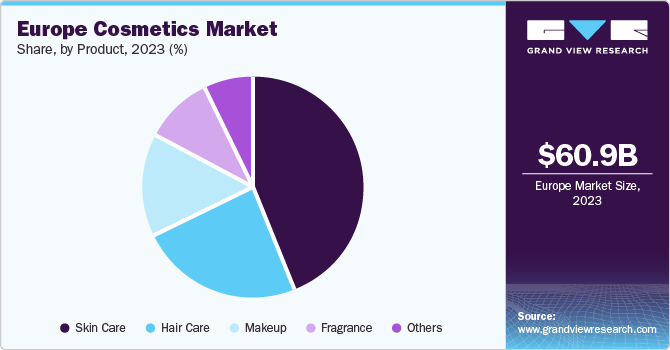

- By Product: Skincare products led the market with 43.60% in 2023 and are expected to maintain dominance through 2030.

Order a free sample PDF of the Europe Cosmetics Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2023 Market Size: USD 60.97 Billion

- 2030 Projected Market Size: USD 87.19 Billion

- CAGR (2024–2030): 5.3%

Key Companies & Market Share Insights

The Europe cosmetics market is highly fragmented, with several domestic and international brands competing for market share. Players are adopting strategies such as acquisitions, innovation, and digital campaigns to enhance visibility and expand their consumer base.

- Coty Inc. – Founded over a century ago, Coty is recognized for pioneering synthetic scents and launching powders as one of its first beauty products. Since 1914, it has built a diverse cosmetics portfolio.

- Avon Products Inc. – Established in 1886 as the California Perfume Company, Avon has been a pioneer in empowering women. In 1939, it rebranded as Avon and later became the first company to stabilize Retinol, introducing its patented BIOADVANCE skincare product.

Key Players

- Coty Inc.

- L'Oréal S.A.

- Estée Lauder Companies Inc.

- Avon Products Inc.

- Unilever PLC

- Procter & Gamble

- Henkel AG & Co. KGaA

- Colgate-Palmolive Co.

- Center 7

- Beiersdorf

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The Europe cosmetics market is poised for steady expansion, supported by growing consumer awareness, product innovation, and shifting beauty standards. With millennials and male consumers emerging as strong growth drivers, brands are leveraging digital platforms, influencer marketing, and acquisitions to strengthen market penetration. As demand for skincare and personal care continues to rise, Europe remains a critical hub for global cosmetics growth.