Europe Automotive Collision Repair Market Grows via Fleet Services

The Europe automotive collision repair market is steadily evolving, driven by the growing complexity of modern vehicles equipped with advanced safety and driver assistance systems.

The Europe automotive collision repair market was valued at USD 84.02 billion in 2023 and is projected to reach USD 89.45 billion by 2030, demonstrating a Compound Annual Growth Rate (CAGR) of 0.9% from 2024 to 2030. A significant driver for this market is the widespread integration of Advanced Driver Assistance Systems (ADAS) in modern vehicles, which include sophisticated sensors, cameras, and radar systems. The repair and calibration of these complex systems after a collision necessitate specialized skills and equipment, thereby boosting the demand for highly trained technicians and advanced repair facilities.

The market's expansion is further propelled by an increasing number of automobile insurance subscriptions and ongoing technological advancements within the automotive industry. This growth is directly linked to the rising incidence of road accidents, leading to a greater need for repair services. Additionally, the market benefits from automobile retailers offering Do-It-Yourself (DIY) kits, catering to consumers who prefer to perform minor repairs on their vehicles independently.

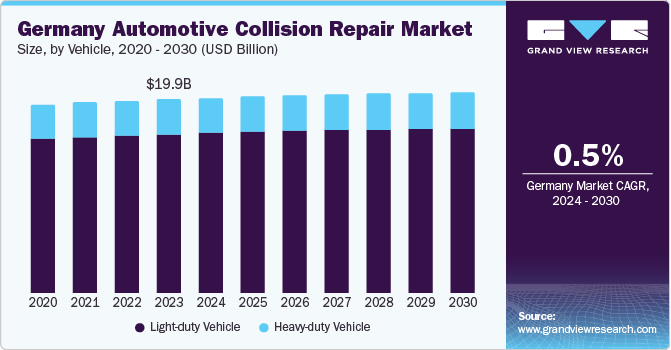

Germany's automotive repair and maintenance sector is experiencing robust growth, fueled by substantial investments in research and development for automobile components in both Original Equipment Manufacturers (OEMs) and aftermarket segments. Automotive collision repair technology plays a crucial role in streamlining assessment and repair procedures for companies, enabling them to reduce repair cycle times by quickly identifying issues and implementing efficient solutions. This technology assists businesses in optimizing their appraisal and repair processes, leading to enhanced operational efficiency and faster resolution of repair-related challenges within the automotive collision repair industry.

Key Market Insights:

- Germany accounted for a significant market share of 23.65% in 2023. Germany's strong automotive industry, continuous technological advancements, high standards of vehicle safety, and a well-established network of collision repair facilities are key factors driving its market dominance.

- France is anticipated to witness the fastest CAGR over the forecast period. This growth is attributed to advancements in automotive technology, such as ADAS and autonomous driving features, which result in more complex and expensive repairs, consequently driving market expansion.

- Based on vehicle type, light-duty vehicles held the highest market share of 80.76% in 2023. Increasing urbanization and population density across many European cities have escalated the demand for compact and efficient transportation solutions, favoring light-duty vehicles like passenger cars and small commercial vehicles.

- By product, spare parts held the highest market share in 2023. The growing complexity of modern vehicles, stringent regulatory requirements concerning vehicle safety and emissions, and the necessity for regular maintenance and servicing have all contributed to the heightened demand for spare parts across various vehicle categories.

- Regarding service channels, OE (Original Equipment, handled by OEMs) held the highest market share in 2023. OEM service channels frequently offer comprehensive service packages that include regular maintenance, repairs, software updates, and diagnostics, providing vehicle owners with a convenient and holistic solution.

Order a free sample PDF of the Europe Automotive Collision Repair Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2023 Market Size: USD 84.02 Billion

- 2033 Projected Market Size: USD 89.45 Billion

- CAGR (2024-2030): 0.9%

Key Companies & Market Share Insights

The prominent players are constantly working towards new product launches, partnerships, mergers and acquisitions (M&A) activities, and other strategic alliances to gain new market avenues and strengthen their competitive edge.

Automotive Technology Products LLC (ATP) plays a significant role in the automotive aftermarket industry, specifically within the collision repair sector. ATP provides a comprehensive range of components essential for the repair process. Their offerings include crash parts, various types of paints and sealants, abrasives for surface preparation, and finishing compounds used to achieve a polished look. ATP is known for supplying aftermarket replacement parts, particularly for automatic transmissions, and has expanded its product line to include filter kits, repair kits, cables, flywheel and ring gears, cabin air filters, and chemicals. Through its "Graywerks by ATP" line, the company also offers exhaust manifolds, harmonic balancers, timing covers, and engine and transmission pans.

Continental AG specializes in a broad array of automotive components and systems, many of which are relevant to vehicle safety and repair after a collision. The company's expertise spans from providing cutting-edge tire technology for enhanced safety and performance to developing advanced brake systems that ensure efficient vehicle control. Beyond these, Continental's offerings extend to vehicle electronics, various automotive safety features (including Advanced Driver Assistance Systems - ADAS components like sensors, cameras, and radar), powertrain elements, and chassis components. Their focus on integrated safety systems, sensor solutions, and advanced driver assistance contributes significantly to the complexity and specialization required in modern collision repair. Continental is also actively engaged in promoting a circular economy within the automotive sector, as demonstrated by their collaboration on remanufacturing DCDC converters for electric vehicles, aiming to extend product lifespans and reduce environmental impact.

Key Players

- 3M Company

- Automotive Technology Products LLC

- Continental AG

- Denso Corporation

- Faurecia (Groupe PSA)

- Honeywell International, Inc.

- International Automotive Components (IAC) Group

- Magna International, Inc.

- Robert Bosch GmbH

- Tenneco, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Europe automotive collision repair market is steadily evolving, driven by the growing complexity of modern vehicles equipped with advanced safety and driver assistance systems. As these technologies become more widespread, the need for specialized repair skills and equipment is increasing. Rising insurance adoption and road accident rates continue to support consistent demand for repair services across the region. Countries like Germany and France are at the forefront due to strong automotive infrastructure and technological progress. Additionally, the market is benefiting from innovations in repair solutions and strategic moves by key players to enhance service capabilities. Overall, the market outlook remains positive, supported by both technological and structural developments.