Europe Automotive Collision Repair Market 2030: Insights from Key Industry Players

the Europe automotive collision repair market, valued at USD 84.02 billion in 2023. Though the pace is a steady 0.9% annual climb projected until 2030, the underlying currents are dynamic and transformative.

Picture the sprawling highways and bustling city streets of Europe, a continent constantly on the move. When the inevitable bump or scrape occurs, a vast and intricate system springs into action: the Europe automotive collision repair market, valued at USD 84.02 billion in 2023. Though the pace is a steady 0.9% annual climb projected until 2030, the underlying currents are dynamic and transformative.

The modern automobile, a marvel of engineering, now bristles with sophisticated Advanced Driver Assistance Systems (ADAS) – an intricate web of sensors, cameras, and radar. When these digital eyes and ears are compromised in a collision, the repair process transcends mere panel beating. It demands a new breed of technician, armed with specialized skills and operating within high-tech repair sanctuaries, capable of recalibrating these crucial safety systems. This technological leap is a significant engine driving the demand for expertise in this evolving landscape.

Fueling this market's steady growth are the ever-increasing subscriptions to automobile insurance, providing a safety net for vehicle owners, alongside the relentless march of technological progress within the automotive realm itself. Ultimately, the primary catalyst remains the unfortunate reality of road accidents, leading to a consistent need for skilled hands and advanced tools to restore vehicles to their former glory. Interestingly, the market also sees a unique dynamic where automotive retailers offer Do-It-Yourself (DIY) kits, empowering some consumers to undertake their vehicle's healing process in the familiar surroundings of their own garages.

Get a preview of the latest developments in the Europe Automotive Collision Repair Market; Download your FREE sample PDF copy today and explore key data and trends

Within this European tapestry, Germany's automotive repair and maintenance sector stands out as a hub of innovation. Driven by significant investments in research and development for both the original components and the aftermarket ecosystem, it's a hotbed of progress. Here, automotive collision repair technology isn't just a tool; it's a strategic advantage. It acts as a digital conductor, streamlining the assessment and repair symphony, enabling companies to swiftly diagnose ailments and implement solutions with remarkable efficiency. This technological prowess translates to optimized workflows and a faster return to the road for repaired vehicles.

In a significant move towards unity and strength, January 2021 witnessed the merging of two prominent European automotive bodies: APRA Europe (the Automotive Parts Remanufacturers Association Europe) and FIRM (the International Federation of Engine Remanufacturers). This powerful alliance brought together over a thousand companies, representing approximately two-thirds of the European automotive remanufacturing workforce. This consolidation forged a unified voice, a cohesive platform to champion, connect, and safeguard the interests of all stakeholders within the automotive remanufacturing sphere – from the remanufacturers themselves to core dealers, wholesalers, suppliers, and the vital researchers pushing the boundaries of this sustainable sector.

Detailed Segmentation

Vehicle Insights

Based on vehicle, light-duty vehicle held the highest market share of 80.76% in 2023. Growing urbanization and population density in many European cities have increased demand for compact and efficient transportation solutions, favoring light-duty vehicles such as passenger cars and small commercial vehicles. Advancements in automotive technology, including electric and hybrid powertrains, have made light-duty vehicles more appealing due to their lower emissions and reduced environmental impact, aligning with stringent emissions regulations in Europe. Light-duty vehicles' convenience, affordability, and versatility make them a preferred choice for individual consumers and businesses, further driving their market share growth.

Product Insights

Based on product, spare parts held the highest market share in 2023. The increasing complexity of modern vehicles, stringent regulatory requirements regarding vehicle safety and emissions, and the need for regular maintenance and servicing have all contributed to the increased demand for spare parts across various vehicle categories. The shift towards sustainable practices and circular economy principles has increased the demand for remanufactured and recycled spare parts, offering cost-effective and eco-friendly alternatives to consumers and businesses. The emphasis on sustainability and reducing carbon footprints has prompted automotive aftermarket players to expand their offerings in remanufactured parts, further driving the growth of the spare parts segment.

Service Channels Insights

Based on service channels OE (handled by OEM's) held the highest market share in 2023. OEM service channels often offer comprehensive service packages encompassing regular maintenance, repairs, software updates, and diagnostics, providing vehicle owners with a convenient and holistic solution. This integrated approach enhances customer satisfaction, creates long-term loyalty, and grows the business. The expansion of vehicle leasing and subscription models, particularly in urban areas, has boosted the demand for OEM service channels, as leasing companies and fleet operators prioritize authorized servicing to maintain vehicle value, reliability, and safety.

Country Insights

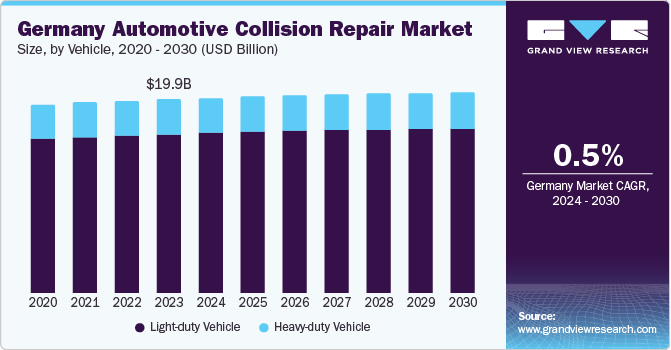

Germany Automotive Collision Repair Market Trends

Germany accounted for a significant market share of 23.65% in 2023. Germany's robust automotive industry, technological advancements, high standards of vehicle safety, and well-established network of collision repair facilities are driving the market. Major automotive manufacturers and suppliers in Germany contribute to a highly skilled workforce and access to innovative solutions, further enhancing the overall driving experience and safety standards.

France Automotive Collision Repair Market Trends

France is expected to witness the fastest CAGR over the forecast period. Advancements in automotive technology, such as ADAS and autonomous driving features, are leading to more complex and expensive repairs, driving growth in the market.

Key Europe Automotive Collision Repair Companies:

- 3M Company

- Automotive Technology Products LLC

- Continental AG

- Denso Corporation

- Faurecia (Groupe PSA)

- Honeywell International, Inc.

- International Automotive Components (IAC) Group

- Magna International, Inc.

- Robert Bosch GmbH

- Tenneco, Inc.

Europe Automotive Collision Repair Market Segmentation

Grand View Research has segmented the Europe automotive collision repair market based on vehicle, product, service channel, and country:

Europe Automotive Collision Vehicle Outlook (Revenue, USD Billion, 2017 - 2030)

- Light-duty vehicle

- Heavy-duty vehicle

Europe Automotive Collision Product Outlook (Revenue, USD Billion, 2017 - 2030)

- Paints & Coatings

- Consumables

- Spare Parts

Europe Automotive Collision Service Channel Outlook (Revenue, USD Billion, 2017 - 2030)

- DIY (Do It Yourself)

- DIFM (Do it For Me)

- OE (handled by OEM's)

Europe Automotive Collision Country Outlook (Revenue, USD Billion, 2017 - 2030)

- Germany

- UK

- France

Curious about the Europe Automotive Collision Repair Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In January 2024, BASF's Coatings Division partnered with industry partners, such as associations and work providers, to create a unified certification standard for the automotive refinishing industry. This effort aims to meet the increasing demand for sustainable accident repairs by defining a standard set of criteria. These criteria will help body shops improve sustainability efforts, ensure compliance with changing legal requirements such as CO2 emission reporting, and foster industry-wide adherence.

- In January 2023, Crash Champions acquired European Collision, a management services organization (MSO) with four repair centers in the Nashville and Atlanta metropolitan areas. This strategic acquisition represented a significant step in Crash Champions' expansion plan. It introduced advanced I-CAR Gold Class repair facilities and prestigious OEM and EV certifications to its network, enhancing its service capabilities and market presence.