Colorado Legal Cannabis Market: Health and Safety Regulations

The Colorado legal cannabis market is expanding rapidly, driven by legalization, strong consumer demand, medical adoption, and product innovations.

The global Colorado legal cannabis market size was valued at USD 2.59 billion in 2024 and is projected to reach USD 5.53 billion by 2030, growing at a CAGR of 12.9% from 2025 to 2030. Growth is being fueled by the legalization of cannabis, rising awareness of its therapeutic benefits, and increasing use for both medical and recreational purposes. Cannabis is widely adopted to help manage neurological conditions such as epilepsy, depression, and anxiety. In addition, technological advancements and improved accessibility of cannabis products are further supporting market expansion.

Since the legalization of medical marijuana in 2000, Colorado’s cannabis industry has experienced strong growth. Supportive legislation and easier access have enabled patients to incorporate cannabis into chronic disease management, including conditions such as arthritis, multiple sclerosis, and cancer. According to the Colorado Department of Public Health and Environment, more than 100,000 patients were registered in the state’s medical marijuana program by 2023. This rise reflects greater public acceptance, positive patient outcomes, and expanding research into the therapeutic potential of cannabinoids.

Cannabis is also gaining importance in managing neurological disorders. For example, surveys conducted by the University of Colorado School of Medicine and the Denver Health Comprehensive Epilepsy Program revealed that many epilepsy patients use marijuana as complementary or alternative therapy.

Innovation is another defining feature of the Colorado cannabis market. Companies are advancing product development and cultivation techniques to meet evolving consumer preferences. For instance, Ripple introduced water-soluble, fast-acting THC products designed for users seeking quick effects. Such innovations not only diversify consumption methods but also attract a broader customer base.

Key Market Insights

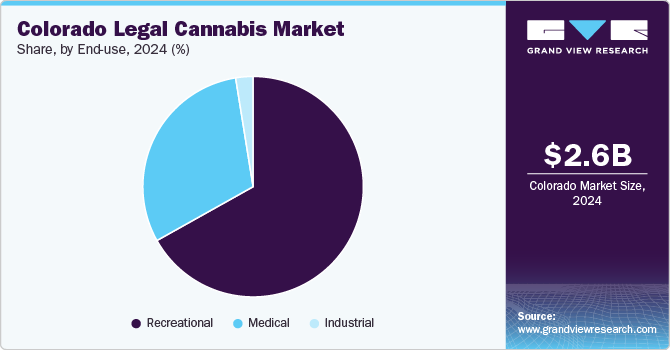

- By source: The marijuana segment dominated with over 85% revenue share in 2024.

- By derivatives: The CBD derivatives segment accounted for more than 65% revenue share in 2024.

- By cultivation: Indoor cultivation led the market with over 56% revenue share in 2024.

- By end use: The medical segment is expected to record strong CAGR growth during the forecast period.

Order a free sample PDF of the Colorado Legal Cannabis Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 2.59 Billion

- 2030 Projected Market Size: USD 5.53 Billion

- CAGR (2025–2030): 12.9%

Key Companies & Market Share Insights

Leading players are strengthening their presence through collaborations, partnerships, and acquisitions.

- December 2024 – The Cannabist Company partnered with Flower by Edie Parker to launch premium products in Colorado, including the Petal Puffer all-in-one vape and cartridges. Plans are also underway to introduce cannabis-infused edibles (Seedies) in Colorado and New York by early 2025.

- December 2024 – The Colorado School of Public Health launched The Tea on THC, an educational campaign highlighting risks linked to high-potency cannabis.

- November 2024 – Voters in Colorado Springs approved recreational marijuana sales, overturning years of restrictions. The ruling allows nearly 90 existing medical dispensaries to also sell recreational cannabis.

Key Players

- Northwest Cannabis Solutions

- The Hollingsworth Cannabis Company, LLC

- Alkaloid Cannabis Company

- Herbs House

- Nirvana Cannabis

- Edgemont Group (Leafwerx)

- Olympia Weed Company

- Canna West Seattle

- Grow Op Farms (Phat Panda)

- Forbidden Farms, LLC

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The Colorado legal cannabis market is expanding rapidly, driven by legalization, strong consumer demand, medical adoption, and product innovations. With evolving regulations and continued investment in cultivation and product development, the industry is positioned for sustained growth through 2030.