Carbon Credit Market Forecast: Investment Opportunities and Future Potential

The global carbon credit market is poised for rapid growth over the coming years, driven by regulatory compliance, voluntary carbon offset initiatives, and growing corporate sustainability efforts.

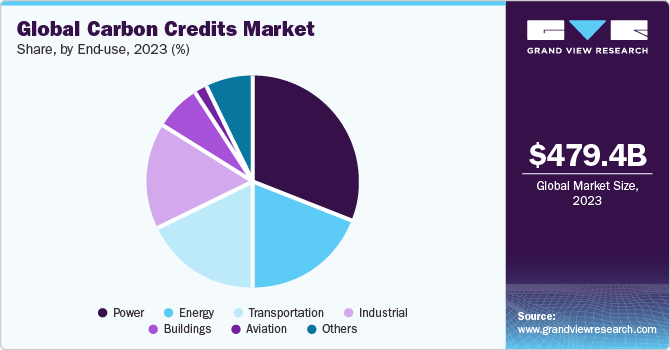

The global carbon credit market size was estimated at USD 479.41 billion in 2023 and is projected to reach USD 4,734.35 billion by 2030, growing at a CAGR of 39.4% from 2024 to 2030. The increasing demand for carbon credits is driven by government policies and regulations aimed at reducing greenhouse gas (GHG) emissions. Companies subject to these regulations often purchase carbon credits to offset emissions and ensure compliance.

For example, the Indian Government’s Energy Conservation Bill, 2022, has paved the way for the establishment of carbon credit markets in the country. Globally, market growth is supported by a combination of state-level programs and voluntary markets, particularly in the U.S., where companies voluntarily purchase carbon credits to reduce their carbon footprint and support sustainability initiatives.

The emphasis on sustainability, corporate social responsibility, and growing concerns about climate change have further boosted demand for carbon credits. However, price volatility remains a key challenge, as fluctuations in demand and supply can complicate long-term planning and affect the financial incentives for emission reduction.

Key Market Trends & Insights

- Europe accounted for the largest revenue share of 89.26% in 2023.

- The U.S. market is expected to grow significantly in the coming years.

- By type, the compliance segment dominated with 98.80% share in 2023.

- By project type, avoidance/reduction projects contributed 66.45% of overall revenue in 2023.

- By end-use, the power segment led with a revenue share of 31.09% in 2023.

Download a free sample PDF of the Carbon Credit Market Intelligence Study, published by Grand View Research.

Market Performance

- 2023 Market Size: USD 479.41 Billion

- 2030 Projected Market Size: USD 4,734.35 Billion

- CAGR (2024–2030): 39.4%

- Europe: Largest market in 2023

Competitive Landscape

Key players are pursuing organic and inorganic growth strategies, including new product development, mergers & acquisitions, partnerships, and joint ventures, to expand and maintain market share.

Notable developments include:

- March 2024: Toucan launched the world’s first String PV inverter market for biochar carbon credits to meet rising demand.

- January 2024: EKI and Jospong Group partnered to generate carbon credits valued at up to USD 1 billion in Ghana.

- December 2023: ACX and CT Group explored carbon credit market opportunities in Vietnam.

- July 2023: JSW expanded its portfolio, aiming to increase carbon credits through projects in solar module manufacturing, battery energy storage systems, and green hydrogen production by 2025.

Framework initiatives are also underway; for instance, in March 2023, the Integrity Council for the Voluntary Carbon Market launched its Core Carbon Principles and Program-level Assessment Framework, setting thresholds for emissions and sustainable development.

Key Companies

- 3Degrees Group, Inc.

- Carbon Care Asia Ltd.

- CarbonBetter

- ClearSky Climate Solutions

- EKI Energy Services Ltd.

- Finite Carbon

- NativeEnergy

- South Pole Group

- Torrent Power Ltd.

- WGL Holdings Inc.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global carbon credit market is poised for rapid growth over the coming years, driven by regulatory compliance, voluntary carbon offset initiatives, and growing corporate sustainability efforts. With continued investment in emission reduction projects and the establishment of robust frameworks for verification and monitoring, the market is expected to become a key tool in global climate change mitigation. However, price volatility remains a challenge that stakeholders must navigate to ensure sustainable growth.