Canada Household Appliances Market: Key Players and Competitive Landscape

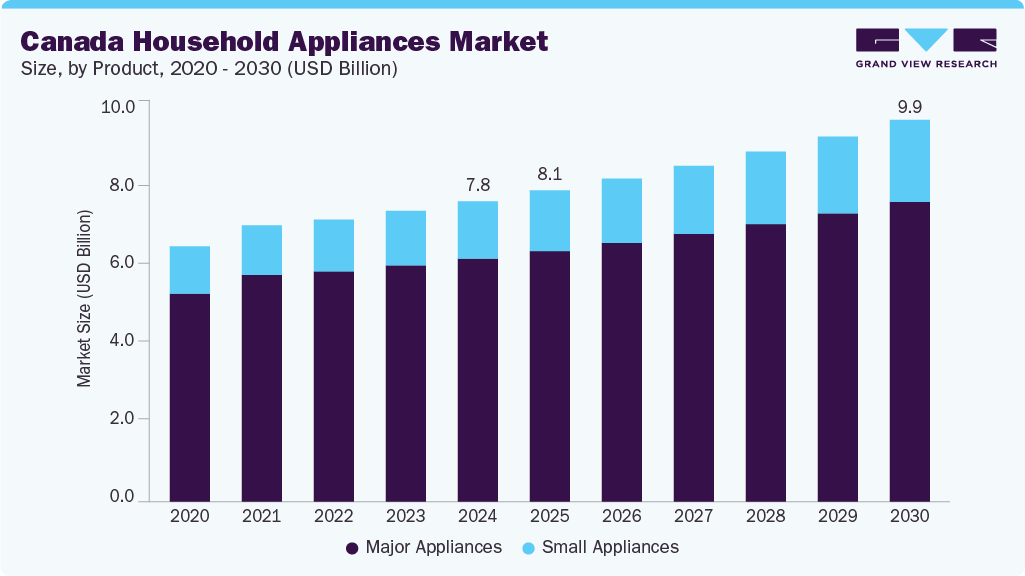

The Canada household appliances market size was valued at USD 7.80 billion in 2024 and is anticipated to reach USD 9.92 billion by 2030.

The Canada household appliances market size was valued at USD 7.80 billion in 2024 and is anticipated to reach USD 9.92 billion by 2030, reflecting a CAGR of 4.2% from 2025 to 2030. Key drivers of this growth include rising disposable incomes, increasing urbanization, and evolving consumer preferences for premium, innovative, and smart appliances that align with modern lifestyles. Technological advancements, particularly in connected, energy-efficient appliances equipped with IoT integration, smartphone control, and eco-friendly features, are crucial to this shift. The Canadian government’s incentives and growing environmental awareness also contribute to a stronger demand for sustainable products. The expanding housing market, especially in urban areas, further supports the demand for a wide range of household appliances, as new homes require state-of-the-art kitchen and laundry equipment.

In urban centers, modern Canadian consumers prioritize convenience and time-saving, which drives demand for compact, multifunctional appliances such as air purifiers and food processors. These appliances address daily tasks like improving air quality and simplifying meal preparation. Compact and versatile designs are particularly attractive for smaller living spaces, where maximizing functionality and space is key.

Sustainability is an increasingly important factor in the Canadian appliance market. Consumers are gravitating toward Energy Star-certified products, which reduce energy and water consumption, aligning with the growing trend toward environmental consciousness. Government incentives, such as Natural Resources Canada's promotion of ENERGY STAR-certified appliances, help reinforce this shift. In March 2025, these appliances were highlighted for their ability to lower electricity bills and reduce carbon footprints, as household appliances account for up to 14.1% of energy usage in the average Canadian home. As a result, manufacturers are innovating eco-friendly appliances, including clothes washers that use 25% less energy and 33% less water than conventional models.

The provinces of Ontario, Quebec, and British Columbia represent over 75% of the Canadian household appliances market. These regions, with their large populations, higher average incomes, and dense urban areas, exhibit strong demand for both major and small appliances. Consumers in these provinces are particularly focused on advanced features, smart connectivity, and energy efficiency, all of which drive ongoing market growth and innovation.

Order a free sample PDF of the Canada Household Appliances Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Small Appliances: Small appliances are projected to experience the fastest growth, with a CAGR of 6.2% during the forecast period. The demand for products such as coffee makers, blenders, and air fryers is driven by consumers’ desire for convenience and multifunctional features. The rise in single-person households and growing disposable incomes also contribute to the popularity of compact, user-friendly appliances. Additionally, the increasing adoption of smart, energy-efficient models with connectivity features further boosts sales, aided by the convenience of online retailing.

- Distribution Channels: Electronic stores dominate the distribution channel landscape, holding a revenue share of 42.9% in 2024. Key retailers such as Whirlpool, Samsung, and LG are widely accessible in these stores. The physical presence of retailers like Canadian Appliance Source, with over 20 locations, ensures broad availability. Innovative retail models, such as the store-in-store concept from Real Canadian Superstore, also enhance availability. According to Statistics Canada, retail sales saw a 2.5% increase in December 2024, continuing the trend of consistent quarterly growth. Competitive pricing, financing options, and omnichannel integration make electronic retail stores the preferred choice for consumers.

Market Size & Forecast

- 2024 Market Size: USD 7.80 Billion

- 2030 Projected Market Size: USD 9.92 Billion

- CAGR (2025-2030): 4.2%

Key Companies & Market Share Insights

Several key players operate in the Canadian household appliances market, including Whirlpool Corporation, Samsung, LG Electronics, AB Electrolux, and Panasonic Holdings Corporation.

- Samsung: Samsung’s portfolio in Canada includes a range of refrigeration, cooking, laundry, and smart appliances. The company’s focus on innovation, smart controls, and energy efficiency, combined with its strong distribution network, is driving its growth in the expanding market.

- LG Electronics: LG offers a wide variety of appliances, including refrigerators, washers, dryers, dishwashers, and small appliances. The company emphasizes energy efficiency, AI-powered smart technology, and robust retail and online distribution, making it well-positioned to meet evolving consumer demands.

Key Players

- Whirlpool Corporation

- Samsung

- LG Electronics

- AB Electrolux (publ)

- Panasonic Holdings Corporation

- Haier Group

- Robert Bosch GmbH

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Canada household appliances market is on an upward trajectory, fueled by advancements in technology, a shift toward sustainability, and increasing demand for convenience and energy efficiency. With key players like Samsung and LG continuously innovating and offering smart, eco-friendly solutions, the market is expected to see steady growth, particularly in urban areas. The increasing adoption of small appliances, coupled with the expansion of online retailing and government incentives for energy-efficient products, will continue to shape the market landscape over the next several years. As consumer preferences evolve toward more connected, multifunctional, and environmentally-conscious products, the market is poised for sustained innovation and growth.