Business Jet Market Growth: Asia Pacific Takes Flight

The global business jet market was valued at USD 72.15 billion in 2024 and is projected to reach USD 113.48 billion by 2030.

The global business jet market was valued at USD 72.15 billion in 2024 and is projected to reach USD 113.48 billion by 2030, expanding at a CAGR of 7.9% from 2025 to 2030. A significant driver behind this growth is the rising number of high-net-worth individuals (HNWIs) and multinational corporations, which continue to increase the demand for business aviation.

Private aircraft serve not only functional purposes but also symbolize wealth and status, particularly among affluent individuals and corporate leaders. These users often have demanding schedules and prefer business jets to efficiently manage travel between multiple destinations in a short timeframe. Unlike commercial aviation, business jets eliminate many common inconveniences such as lengthy security checks, unexpected delays, and fixed flight timetables.

Additionally, business jets are capable of operating from smaller regional airports or private airstrips that are closer to passengers’ desired destinations. This is particularly beneficial in areas with underdeveloped commercial aviation infrastructure. Such convenience allows for quick departures, reduced travel time, and the flexibility to modify itineraries at short notice.

Business jets cater to both short and long-range travel needs. Leading Original Equipment Manufacturers (OEMs) like Boeing, Gulfstream, and Dassault Aviation offer a broad portfolio of aircraft tailored to various mission profiles. These jets provide a secure and private travel environment, which is especially valued by high-profile individuals and corporations dealing with sensitive or confidential matters, particularly in geopolitically unstable regions. These features collectively contribute to the steady expansion of the business jet industry.

Order a free sample PDF of the Business Jet Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America led the global business jet market in 2024, accounting for 37.8% of total revenue. The region’s robust economy, especially in the U.S. and Canada, and its high concentration of HNWIs and industrial leaders have driven strong demand for private aviation.

- Large business jets represented the dominant aircraft type in 2024, capturing a 48.1% revenue share. This segment's popularity is fueled by the increasing need for long-range travel and capacity to transport more passengers. Technological advancements in aerodynamics, engine efficiency, and onboard systems further enhance the attractiveness of larger models.

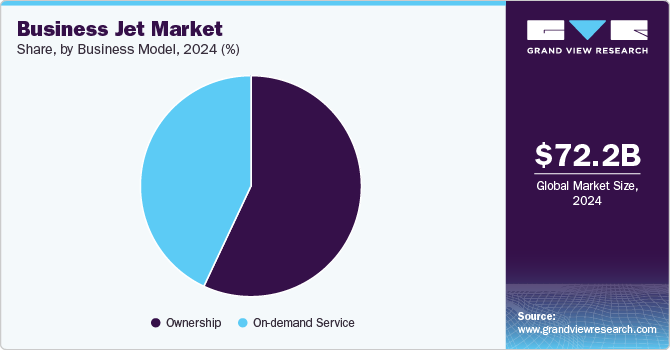

- Ownership-based business models—including full and fractional ownership—held the largest market share in 2024. Full ownership provides users with complete control over aircraft usage, customization, and scheduling, making it the preferred choice for frequent flyers and corporations.

Market Size & Forecast

- 2024 Market Size: USD 72.15 Billion

- 2030 Projected Market Size: USD 113.48 Billion

- CAGR (2025-2030): 7.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Several leading companies play a critical role in shaping the global business jet industry:

- Textron Aviation (U.S.) manufactures a wide range of general aviation aircraft through its Cessna and Beechcraft brands. Its broader portfolio includes component and service divisions like Able Aerospace Services, McCauley Propeller Systems, and TRU Simulation + Training.

- Dassault Aviation (France) is known for its Falcon series of business jets, including models such as the Falcon 10X, 8X, 6X, 900LX, and 2000LXS. These aircraft support ranges between 7,400 km and 13,900 km and are operated in over 90 countries by approximately 1,300 operators, with more than 2,100 Falcons in active service.

Key Players

- Airbus SE

- Textron Aviation, Inc.

- The Boeing Company

- Bombardier, Inc.

- Dassault Aviation SA

- Embraer S.A

- Gulfstream Aerospace Corporation

- Pilatus Aircraft Ltd.

- SyberJet LLC

- Jet Linx Aviation

- Magellan Jets, LLC

- NetJets IP, LLC

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global business jet market is poised for significant growth through 2030, fueled by rising global wealth, expanding corporate travel needs, and technological advancements in aircraft design and performance. North America remains the dominant region, while Asia Pacific is expected to witness the fastest expansion. With increasing demand for efficiency, flexibility, and privacy in travel, business aviation continues to solidify its role as a strategic asset for high-net-worth individuals and corporations alike. Leading OEMs are expected to benefit from this upward trend by offering technologically advanced, range-optimized, and customer-centric aircraft solutions.