Breast Cancer Diagnostics Market in Hospitals: Trends & Regional Forecasts

The breast cancer diagnostics market is poised for significant growth over the forecast period, driven by rising disease prevalence, enhanced awareness, and technological advancements in imaging and molecular diagnostics.

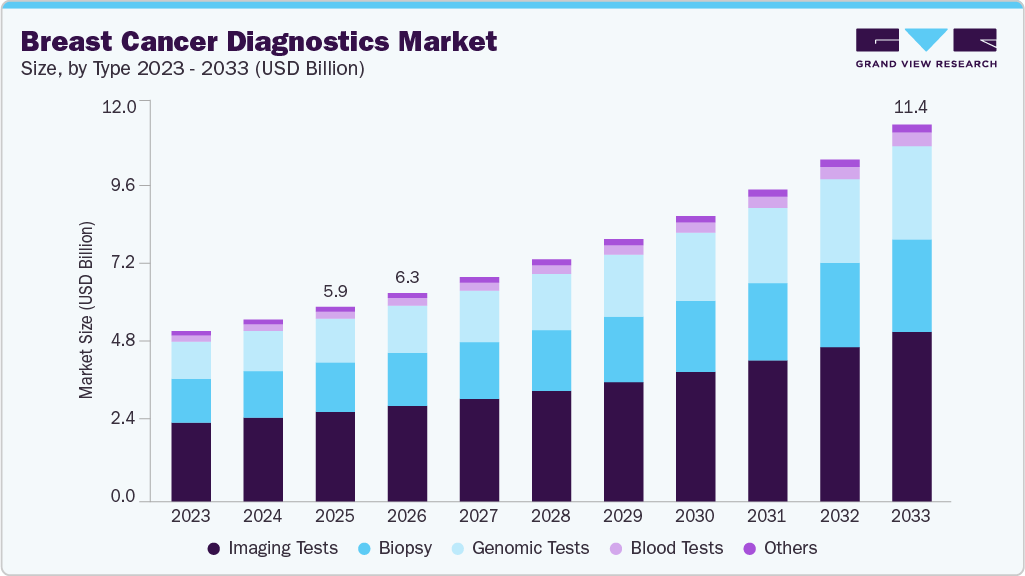

The global breast cancer diagnostics market was valued at USD 5.48 billion in 2024 and is projected to reach USD 11.36 billion by 2033, growing at a CAGR of 8.6% from 2025 to 2033. This growth is primarily driven by the rising prevalence of breast cancer and increasing government initiatives aimed at enhancing screening and diagnostic rates.

The growing incidence of breast cancer is a major factor fueling the market. According to the American Cancer Society’s Breast Cancer Facts & Figures 2024, breast cancer remains the most commonly diagnosed cancer among women in the United States. In 2024, approximately 310,720 new cases of invasive breast cancer and 55,720 cases of ductal carcinoma in situ (DCIS) were expected to be reported.

Factors contributing to the increasing incidence include aging populations, lifestyle changes, genetic predisposition, and environmental influences. As life expectancy rises, more women reach age groups with higher breast cancer risk. Additional risk factors such as obesity, sedentary lifestyles, hormonal therapies, and delayed childbearing are associated with a higher likelihood of developing the disease. Improved awareness and widespread screening programs have also resulted in more cancers being detected at earlier stages, expanding the need for effective diagnostic technologies.

Mammography continues to be the gold standard for breast cancer screening, while advancements in digital breast tomosynthesis (DBT), contrast-enhanced mammography, ultrasound, MRI, and molecular diagnostic tests are driving market growth. The integration of artificial intelligence (AI) in imaging interpretation has further enhanced early detection capabilities, improving accuracy while reducing false positives and negatives. In addition, liquid biopsy and biomarker-based diagnostics are emerging as non-invasive methods for detecting breast cancer and monitoring treatment response.

Key Market Trends & Insights

- North America dominated the breast cancer diagnostics market, accounting for 46.60% of global revenue in 2024.

- The U.S. held the largest market share in the North American region.

- By type, the imaging segment led the market with a 51.98% share in 2024.

- By product, instrument-based products captured the largest market share at 71.42% in 2024.

- By application, the diagnostic & predictive segment dominated, holding 48.69% of revenue in 2024.

Download a free sample PDF of the Breast Cancer Diagnostics Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 5.48 Billion

- 2033 Projected Market Size: USD 11.36 Billion

- CAGR (2025–2033): 8.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Competitive Landscape

Key market players are focusing on strategic initiatives such as product launches, mergers & acquisitions, and partnerships. Many companies are also investing in the development of advanced testing services, boosting overall demand. For instance, in June 2023, Thermo Fisher Scientific, Inc. partnered with Pfizer, Inc. to enhance next-generation sequencing (NGS) testing for breast and lung cancer patients.

Prominent Companies

- Hologic Inc.

- Genomic Health (Exact Sciences Corporation)

- BD

- Danaher

- Koninklijke Philips N.V.

- QIAGEN

- Thermo Fisher Scientific Inc.

- Argon Medical Devices, Inc.

- Myriad Genetics

- F. Hoffmann-La Roche Ltd.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The breast cancer diagnostics market is poised for significant growth over the forecast period, driven by rising disease prevalence, enhanced awareness, and technological advancements in imaging and molecular diagnostics. Adoption of AI-enabled tools, non-invasive testing methods, and advanced instruments is improving early detection and diagnostic accuracy, while government initiatives and screening programs further support market expansion. Strategic partnerships and innovations by leading players will continue to strengthen the market, ensuring robust growth and improved patient outcomes globally.