Breaking Down Barriers in the Small Molecule Innovator API CDMO Market

The global small molecule innovator API CDMO market was valued at USD 32.25 billion in 2024 and is expected to reach USD 47.14 billion by 2030.

The global small molecule innovator API CDMO market was valued at USD 32.25 billion in 2024 and is expected to reach USD 47.14 billion by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The growth of this market is driven by the increasing demand for small-molecule drugs, rising outsourcing by pharmaceutical companies, and the growing number of clinical trials.

Several factors are contributing to the market's expansion, including increasing pharmaceutical investments in R&D to develop new small molecule innovator APIs, rising demand for novel therapies, and the growing prevalence of cancer and age-related disorders. Small molecules continue to play a crucial role in developing new treatments worldwide. For example, the U.S. FDA approved 50 new drugs in 2024, up from 37 approvals in 2022, with 31 of these being small molecule therapies, representing 56% of total approvals—an increase from 46% in 2023. This surge in drug approvals is expected to further drive the market's growth.

Moreover, the trend of outsourcing pharmaceutical activities is on the rise as companies seek additional competencies necessary for successful drug development and commercialization. Outsourcing provides critical expertise, improves cash flow management, and offers manufacturing advantages, such as reduced investment risks. Establishing expensive in-house capabilities for early-stage technologies and products presents significant risks during development, while outsourcing serves as a risk-averse solution until market demand becomes more established.

Order a free sample PDF of the Small Molecule Innovator API CDMO Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Asia Pacific's Market Leadership: Asia Pacific held the largest market share of 41.74% in 2024. Over the past decade, the outsourcing of pharmaceutical manufacturing to Asian countries such as India and China has contributed to this dominance. The region is expected to experience rapid growth due to rising healthcare expenditure, increasing chronic disease prevalence, and improvements in healthcare infrastructure. These factors are expected to drive demand for small molecule APIs and CDMO services to support drug development and manufacturing.

- Clinical Stage Segment Dominance: The clinical stage segment accounted for 54.56% of the global revenue in 2024. This segment is further divided into Phase I, Phase II, and Phase III, with growth driven by improved access to medicines, a robust small molecule development pipeline, and the launch of new drugs. Clinical CDMOs provide essential support for drug formulation, clinical trials, scale-up, validation, and large-scale commercial manufacturing. Their expertise helps expedite the drug development process, fueling market demand for clinical-stage services.

- Pharmaceutical Industry's Dominance: The pharmaceutical segment was the largest customer type in 2024, accounting for 91.07% of the market revenue. Small-molecule drugs have been a cornerstone of the pharmaceutical industry for decades. Many pharmaceutical companies are increasingly relying on CDMOs to develop novel small molecule innovator APIs for various therapeutic areas, including oncology, immunology, and infectious diseases. This reliance has driven medical breakthroughs and helped address unmet medical needs, improving patient outcomes.

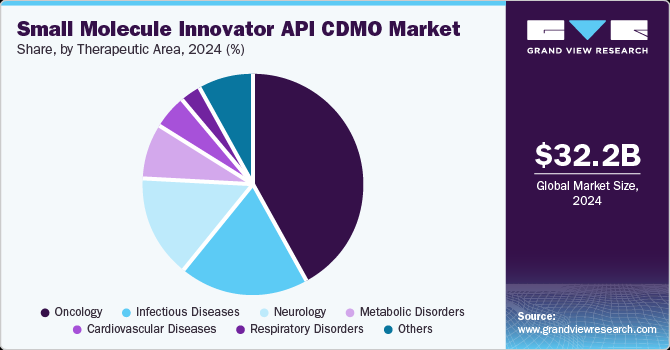

- Oncology's Leading Role: The oncology segment was the largest therapeutic area in 2024 and is projected to grow at the fastest CAGR of 6.80% during the forecast period. The rising global cancer incidence is a primary driver for this growth. For instance, the Cancer Atlas forecasts that there will be 29 million cancer cases worldwide by 2040. The demand for oncology drugs is increasing, driven by advances in targeted therapies and personalized medicine, which, in turn, is driving the need for small molecule innovator API CDMOs.

Market Size & Forecast

- 2024 Market Size: USD 32.25 Billion

- 2030 Projected Market Size: USD 47.14 Billion

- CAGR (2025-2030): 6.4%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

The small molecule innovator API CDMO market is highly competitive, with key players focusing on inorganic strategies such as mergers, partnerships, and acquisitions to increase their global presence. Prominent companies in the market are adopting strategic initiatives like service launches, joint ventures, and expansions to enhance their market share and revenue.

For example, in August 2024, Lonza expanded its small molecule facility in Bend, Oregon, by adding clinical bottling and labeling capabilities. This enhancement is expected to improve support for customers involved in early-stage development, strengthening the company’s position in the market.

Key Players

- Lonza Group Ltd.

- Novo Holdings (Catalent, Inc.)

- Thermo Fisher Scientific, Inc.

- Siegfried Holding AG

- Recipharm AB

- CordenPharma International

- Samsung Biologics

- Labcorp

- Ajinomoto Bio-Pharma Services

- Piramal Pharma Solutions

- Jubilant Life Sciences (Jubilant Biosys Limited)

- WuXi AppTec Co., Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global small molecule innovator API CDMO market is expected to see significant growth, driven by the rising demand for small-molecule drugs, increasing pharmaceutical outsourcing, and the growing number of clinical trials. The market is heavily influenced by trends such as pharmaceutical investments in R&D, particularly in oncology, and the increasing approval of new small molecule therapies. Asia Pacific is set to remain the largest market, while it is also projected to grow rapidly due to the region's expanding healthcare sector. As pharmaceutical companies continue to outsource drug development and manufacturing to CDMOs, the market for small molecule innovator APIs will continue to flourish, supported by strategic industry partnerships and innovations. The growing focus on oncology and other therapeutic areas further highlights the role small molecule innovator APIs will play in addressing global health challenges.