Brazil Office Supplies Market: How Writing Supplies Are Evolving?

The Brazil office supplies market was valued at USD 590.6 million in 2024 and is projected to grow to USD 619.8 million by 2030.

The Brazil office supplies market was valued at USD 590.6 million in 2024 and is projected to grow to USD 619.8 million by 2030, expanding at a CAGR of 0.8% from 2025 to 2030. The rapid rise of small and medium-sized enterprises (SMEs) in Brazil has led to the creation of more efficient and well-equipped workspaces. With a population exceeding 217 million in 2025 and recognized as the world’s eighth-largest economy by GDP purchasing power, Brazil offers a large market for SME growth.

The country’s dynamic technology sector, particularly within the growing digital economy, fintech, and generative AI, also supports the demand for office supplies. Brazil has one of the highest internet penetration rates globally and is a hub for innovation. The growth of data centers and the increasing adoption of cloud technologies create substantial opportunities for businesses, increasing the need for office supplies to support operations. São Paulo, a key center for the EdTech industry, is home to approximately 566 EdTech startups as of 2023, further driving the demand for office products.

In addition, Brazil's expanding education sector has significantly fueled the demand for office supplies. This growth is attributed to rising student enrollments and government priorities in education. In 2023, the Ministry of Education's budget was projected at USD 29 billion, supporting Brazil’s 46.7 million primary school students and 8.4 million higher education students, with 75% attending private institutions. The OECD also reports a decrease in the percentage of 25-34-year-olds without upper secondary qualifications between 2016 and 2023, highlighting the country’s increasing focus on education. Moreover, distance learning surpassed in-person courses in 2023, marking a shift in educational models. This surge in enrollment drives the demand for stationery, notebooks, and other academic supplies.

The e-commerce boom and the rising demand for sustainable products are reshaping the office supplies market. Online channels, offering convenience and a wide range of products, are contributing to market growth. Furthermore, consumers are increasingly choosing eco-friendly alternatives, which is prompting manufacturers to innovate in sustainability. This trend aligns with environmental concerns and is influencing purchasing behavior in the office supplies market.

Order a free sample PDF of the Brazil Office Supplies Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Product Segment: Paper supplies led the market, accounting for 34.7% of the market share in 2024. Paper products, including notebooks and writing paper, remain essential office items, with strong domestic production supporting demand. In 2023, Brazil produced 10.8 million tons of paper, with nearly 80% consumed locally.

- Distribution Channels: Offline retail channels dominated, capturing 91.4% of the market revenue in 2024. Brick-and-mortar stores, such as supermarkets, hypermarkets, and specialty outlets, offer immediate availability and a tactile shopping experience, particularly for items like paper and pens. Corporate and educational institutions also prefer offline purchases for bulk procurement.

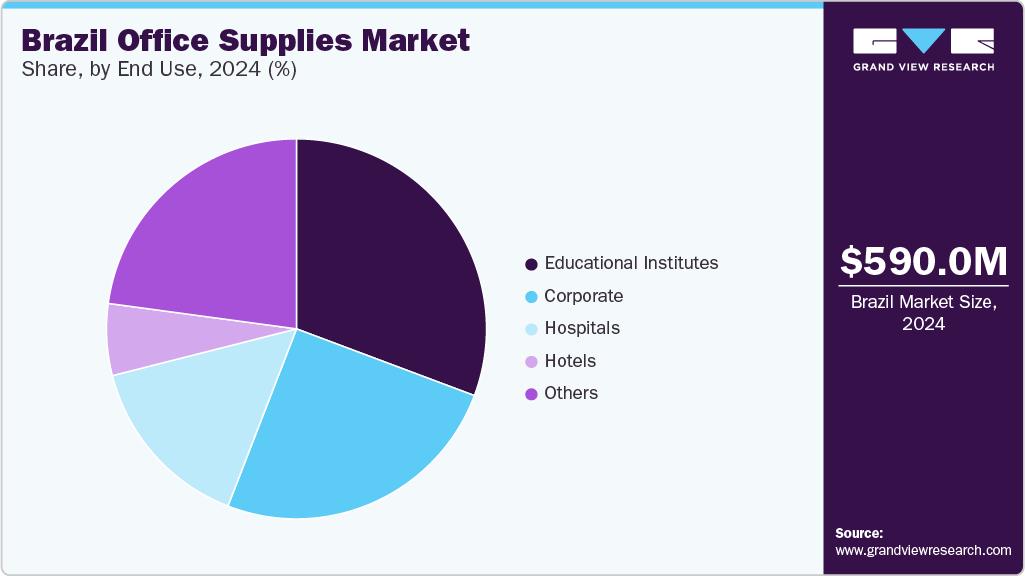

- End Use: The education sector held the largest market share, contributing 30.7% of revenue in 2024. Brazil’s education system, with 13 years of compulsory education, has driven significant demand for office supplies, particularly writing instruments and notebooks, as student populations continue to grow.

Market Size & Forecast

- 2024 Market Size: USD 590.6 Million

- 2030 Projected Market Size: USD 619.8 Million

- CAGR (2025-2030): 0.8%

Key Companies & Market Share Insights

Key players in the market include KOKUYO Co., Ltd., Pentel, 3M, Faber-Castell, and BIC. These companies focus on innovation, product diversification, and eco-friendly options to meet market demands. Government initiatives have supported local production and the education sector, fostering market growth despite challenges such as supply chain disruptions and pricing pressures.

- Faber-Castell: The German multinational has a strong footprint in Brazil, with production plants in São Carlos and Manaus. The São Carlos facility manufactures a range of office supplies, including school, technical, and fine arts products. Faber-Castell operates globally, providing affordable and diverse products for both children and professionals.

- BIC: Operating in Brazil since 1966, BIC has its headquarters in São Paulo and a manufacturing facility in Manaus. The Manaus plant produces various iconic products such as pens, razors, and lighters. BIC Brazil’s focus is on wholesale distribution, offering affordable and high-quality items.

Key Players

- KOKUYO Co.,Ltd.

- Pentel

- 3M

- Faber-Castell

- BIC

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Brazil office supplies market is poised for steady growth, supported by factors such as the rise of SMEs, expansion of the education sector, and increasing e-commerce adoption. The market’s steady growth rate of 0.8% CAGR from 2025 to 2030 reflects the ongoing demand for essential office products, driven by the country’s economic and technological advancements. With continued innovation in sustainable product offerings and strong retail distribution channels, the Brazilian office supplies market is well-positioned for future expansion.