Bioprocess Containers Market Predictions: What to Expect by 2033?

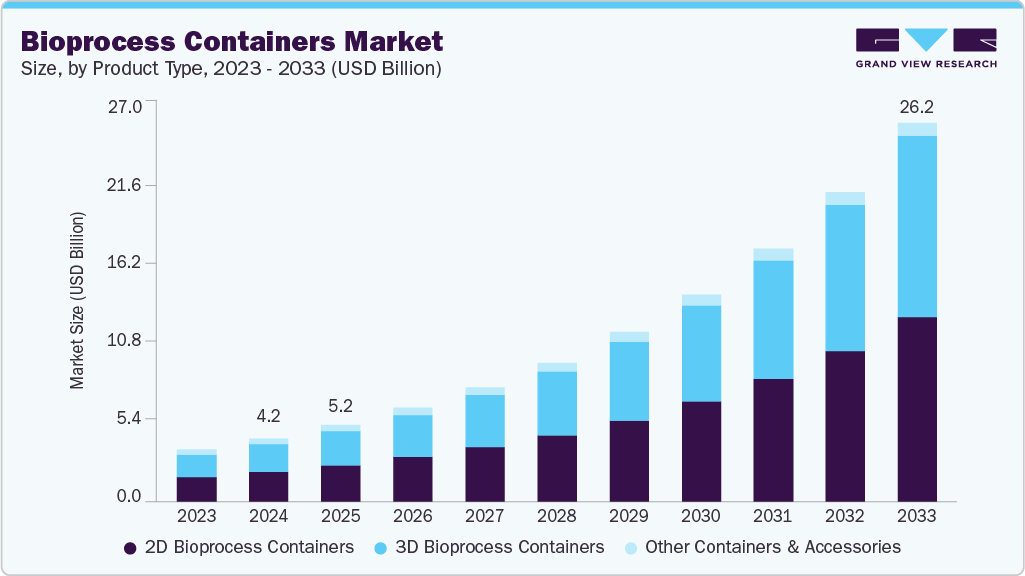

The global bioprocess containers market was valued at USD 4.21 billion in 2024 and is projected to reach USD 26.22 billion by 2033.

The global bioprocess containers market was valued at USD 4.21 billion in 2024 and is projected to reach USD 26.22 billion by 2033, expanding at a CAGR of 22.6% from 2025 to 2033. This robust growth is primarily driven by the rising demand for single-use technologies in biopharmaceutical manufacturing, alongside the need for cost-effective, scalable, and contamination-free production processes.

The increasing production of biologics and the demand for flexible manufacturing facilities are further propelling market expansion. Bioprocess containers, typically constructed from polymer films, are increasingly replacing traditional stainless-steel systems due to their flexibility, lower capital investment, and reduced risk of cross-contamination. As biopharmaceutical companies scale production to meet growing demands for monoclonal antibodies, vaccines, and cell and gene therapies—especially following the COVID-19 pandemic—single-use solutions like bioprocess containers provide faster, more economical options for both upstream and downstream processes. Companies such as Thermo Fisher Scientific Inc. and Sartorius AG are actively broadening their portfolios of disposable bioprocessing solutions to meet this demand.

Additionally, the surge in contract manufacturing organizations (CMOs) and contract research organizations (CROs) is significantly influencing market growth. These organizations rely heavily on scalable, disposable systems to serve multiple clients without lengthy sterilization cycles. The modularity and ease of changeover offered by bioprocess containers allow rapid adaptation to different biologics projects. This trend is particularly notable in emerging markets like India, South Korea, and Brazil, where CMOs are investing in advanced single-use bioprocessing infrastructure to attract global biopharmaceutical clients.

The market is also driven by strict regulatory mandates emphasizing aseptic processing and contamination control. Agencies such as the FDA and EMA mandate validated sterile environments for biologics production. Pre-sterilized, disposable bioprocess containers help manufacturers comply with these regulations by minimizing contamination risk and reducing cleaning validation burdens.

Order a free sample PDF of the Bioprocess Containers Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Leadership: Asia Pacific led the bioprocess containers market with the largest revenue share of over 36.0% in 2024 and is expected to experience the fastest growth with a CAGR of 23.3% during the forecast period. This growth is fueled by expanding biopharmaceutical production, government investments in healthcare infrastructure, and rising demand for biologics and biosimilars.

- By Product: The 2D bioprocess containers segment captured the largest revenue share of over 47.0% in 2024. These flat, single-use bags are commonly used for small-volume applications like sampling, storage, mixing, and fluid transfer. Made from multi-layer polymer films, they provide chemical resistance, sterilizability, and compatibility with a broad range of biopharmaceutical substances.

- By Application: The upstream processes segment accounted for the largest revenue share of over 57.0% in 2024 and is projected to grow at the fastest rate with a CAGR of 23.3%. Upstream bioprocessing includes initial stages such as cell culture, fermentation, and media preparation.

- By End Use: The pharmaceutical and biopharmaceutical companies segment held the largest market share of over 60.0% in 2024. These companies are the primary users of bioprocess containers for both upstream and downstream processes, including media preparation, fermentation, harvest, and buffer storage.

Market Size & Forecast

- 2024 Market Size: USD 4.21 Billion

- 2033 Projected Market Size: USD 26.22 Billion

- CAGR (2025-2033): 22.6%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Leading players in the bioprocess containers market are actively implementing strategies such as expansion initiatives and partnerships to strengthen their market presence and broaden the availability of their products and services. These efforts are key drivers supporting the ongoing growth and innovation within the industry.

Key Players

- Thermo Fisher Scientific Inc.

- Merck

- Saint-Gobain

- ALLpaQ PACKAGING GROUP

- Parker Hannifin Corp

- Kiefel

- Sartorius AG

- BioPharma Dynamics Ltd

- Shandong Huazhilin Pharmaceutical Technology Co. ,Ltd.

- System-c Bioprocess

- CellBios

- ESI Ultrapure

- Entegris

- Liquidyne Process Technologies, Inc.

- Vonco Products, LLC

- 3CON Anlagenbau GmbH

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global bioprocess containers market is set for rapid expansion, driven by the growing adoption of single-use technologies in biopharmaceutical manufacturing and the increasing demand for flexible, scalable, and contamination-free production solutions. The shift from traditional stainless-steel systems to disposable polymer-based containers is accelerating, supported by regulatory requirements and the expanding needs of CMOs and CROs worldwide. With Asia Pacific leading growth and key players investing in innovative solutions and strategic partnerships, the market is well-positioned to meet the evolving demands of the biopharmaceutical industry through 2033.