Bio Solvents Market 2030: The Power of Renewable Resources in Industrial Applications

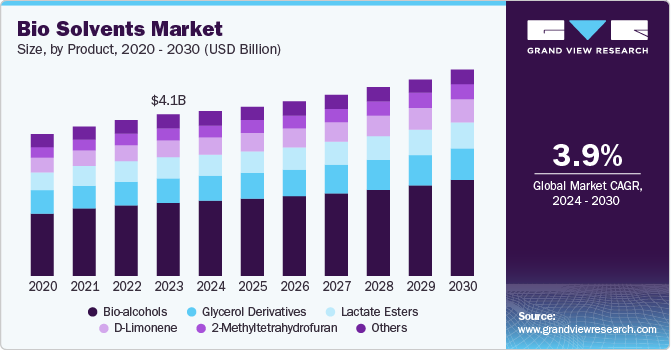

The global bio solvents market is experiencing a surge of green energy, with its size valued at USD 4.06 billion in 2023 and projected to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030.

The global**** bio solvents market is experiencing a surge of green energy, with its size valued at USD 4.06 billion in 2023 and projected to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030. A primary engine behind this expansion is the escalating concern for our environment, coupled with increasingly stringent government regulations. These forces are actively pushing industries to pivot towards more eco-friendly solvent alternatives. Bio solvents, with their roots in renewable resources, emerge as a truly sustainable and significantly less toxic option compared to their conventional petroleum-based counterparts.

Furthermore, the growing demand from crucial end-use industries like paints and coatings, adhesives, and pharmaceuticals—all actively seeking greener and safer solvent solutions—is robustly fueling market growth. Adding to this momentum, continuous advancements in technology and heightened research and development (R&D) activities are leading to the creation of high-performance bio solvents, thereby accelerating their adoption across various applications.

Regulations are playing an undeniably significant role in shaping the global bio-solvents market landscape. Notably, the Farm Security and Rural Investment Act of the Public Law 107-171 in the U.S. and the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) by the European Union (EU) have made it imperative for manufacturers to integrate bio-based materials into their production processes. These regulations are a direct response to the environmental and health hazards posed by synthetic solvents, which can cause irritation to the skin, eyes, and nose, and release harmful volatile organic compounds (VOCs) into the atmosphere.

Get a preview of the latest developments in the Bio Solvents Market; Download your FREE sample PDF copy today and explore key data and trends

Beyond these specific mandates, broader environmental regulations imposed by leading authorities in numerous countries, particularly across Europe and North America, are powerfully driving the growth of the bio solvents market. These regulations are strategically designed to limit the use of synthetic solvents, which pose serious risks to both human health and the natural environment. As a prime example, the Environmental Protection Agency (EPA) and the Department for Environment, Food and Rural Affairs (DEFRA) have implemented stringent regulations concerning the toxicity content of conventional solvents.

Detailed Segmentation

Products Insights

The bio-alcohol product segment dominated the market and accounted for a share of 45.6% in 2023 owing to its widespread adoption in industries such as pharmaceuticals, food and beverages, where bioethanol and biobutanol serve as sustainable alternatives to petrochemical solvents. The increasing demand for eco-friendly products, coupled with supportive government regulations promoting renewable resources, has driven the adoption of bio-alcohols. As industries focus on reducing their carbon footprints and minimizing environmental impacts, bio-alcohols are likely to maintain their leading position in the market.

End-use Insights

The paint & coatings segment dominated the market share with 31.5% in 2023 driven by the increasing demand for environmentally friendly and sustainable solutions within the coatings industry. Manufacturers are increasingly adopting bio solvents to comply with stringent VOC regulations and to cater to the rising consumer demand for green products. The segment’s dominance is also fueled by innovations in bio solvent formulations, which have improved their compatibility with a wide range of coating materials, including waterborne and high-solids systems. These advancements not only enhance performance but also reduce the environmental footprint of the coatings, making bio solvents an attractive option for both industrial and decorative applications. The growing construction and automotive industries, coupled with the increased focus on sustainable practices, have further propelled the use of bio solvents in this segment.

Regional Insights

North America dominated the global bio solvents market in 2023 with a share of 28.4% primarily driven by the escalating demand for environmentally friendly alternatives to traditional petroleum-based solvents, catalyzed by stringent regulatory mandates. Moreover, the presence of industry leaders such as Cargill Incorporated and Stepan Company within the region positions North America as a strategic hub for bio solvent development and commercialization, fostering robust growth prospects.

Key Bio Solvents Companies:

The following are the leading companies in the bio solvents market. These companies collectively hold the largest market share and dictate industry trends.

- Stepan Company

- Tri-Chem Specialties.

- ADM

- POET, LLC.

- BASF

- CREMER OLEO GmbH & Co.

- Corbion

- Dow

- Cargill, Incorporated.

Bio Solvents Market Segmentation

Grand View Research has segmented the global bio solvents market based on product, end-use, and region:

Bio Solvents Product Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

- Bio-alcohols

- Glycerol Derivatives

- D-Limonene

- Lactate Esters

- 2-Methyltetrahydrofuran

- Others

Bio Solvents End-use Outlook (Revenue, USD Million, 2018 – 2030)

- Chemical Intermediates

- Pharmaceuticals

- Printing Inks

- Paints & Coatings

- Cosmetics & Personal Care

- Others

Bio Solvents Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Belgium

- Netherlands

- Asia Pacific

- China

- India

- South Korea

- Vietnam

- Thailand

- Indonesia

- Latin America

- Brazil

- Argentina

- Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- South Africa

Curious about the Bio Solvents Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In January 2024, Syensqo Ventures led a USD 2.1 million investment in Bioeutectics, alongside Atento Capital, SOSV, and Fen Ventures. The funding will support Bioeutectics' expansion of its biotechnology platform focused on developing renewable materials and products, such as bio solvents, for applications in the agro, industrial, food, and biopharma sectors.

- In July 2023, Circa Group AS, the coordinator of the EU-funded ReSolute project, filed patent applications for two novel solvents designed for carbon capture processes. Developed over the past year from the project's platform molecule, levoglucosenone (LGO), the solvents, dubbed Furatech:1 and Furatech:2.