Barrier Films For Pharmaceutical Packaging Market By Product Type, Application, Region

The barrier films for pharmaceutical packaging market is set for steady growth, driven by rising demand for drug safety, extended shelf life, and compliance with stringent regulatory standards.

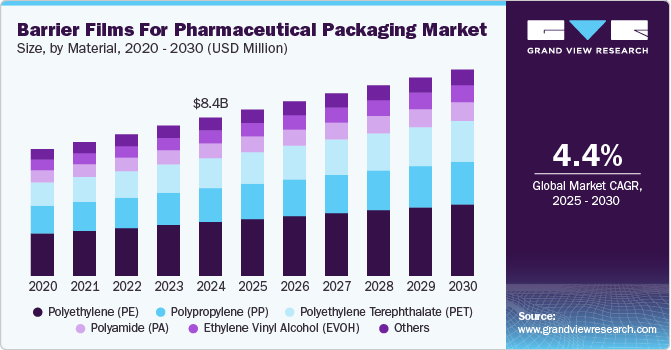

The global barrier films for pharmaceutical packaging market was valued at USD 8.39 billion in 2024 and is projected to reach USD 10.94 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. Market growth is driven by the increasing demand for extended shelf life and protection against moisture, oxygen, and light.

The rising prevalence of chronic diseases, coupled with growing regulatory emphasis on product safety, further supports market expansion. Barrier films are particularly critical for protecting moisture- and oxygen-sensitive drugs such as effervescent tablets, biologics, and antibiotics, ensuring their potency and efficacy over time. Increasing focus on patient safety and compliance with stringent quality standards has prompted pharmaceutical companies to adopt advanced packaging solutions like high-barrier films.

Key Market Trends & Insights

- Asia Pacific dominated the global market, accounting for over 41.0% of total revenue in 2024.

- By material, polyethylene (PE) led the market with a revenue share exceeding 34.0% in 2024.

- By product, multilayer films recorded the largest market share of over 46.0% in 2024.

- By application, blister packaging accounted for the largest share, exceeding 41.0% in 2024.

Download a free sample PDF of the Barrier Films For Pharmaceutical Packaging Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 8.39 Billion

- 2030 Projected Market Size: USD 10.94 Billion

- CAGR (2025–2030): 4.4%

- Asia Pacific: Largest regional market in 2024

Competitive Landscape

The barrier films for pharmaceutical packaging market is highly competitive, with global and regional players investing in product innovation, regulatory compliance, and sustainability initiatives. Leading companies focus on developing multilayer films and advanced materials such as PVDC and EVOH, alongside eco-friendly alternatives.

The market is heavily influenced by stringent pharmaceutical packaging regulations, prompting companies to invest in R&D and form strategic partnerships to meet safety, shelf-life, and barrier property requirements. Emerging players are also gaining traction by offering cost-effective and sustainable solutions, intensifying competition.

Notable Developments:

- In May 2024, TOPPAN Holdings Inc. and India-based TOPPAN Speciality Films (TSF) announced plans to produce GL-SP in India, a BOPP-based barrier film for sustainable packaging. GL-SP delivers barrier performance comparable to vapor-deposited PET, providing excellent protection against oxygen and water vapor for applications in pharmaceuticals, food, and industrial materials.

- In October 2023, Solvay launched Diofan Ultra736, an ultra-high barrier PVDC coating solution for pharmaceutical blister films. The product offers superior water vapor protection, enables thinner coating structures, reduces carbon footprint, and meets regulatory requirements for direct pharmaceutical contact, while maintaining excellent oxygen barrier, chemical resistance, transparency, and thermoformability.

Prominent Companies

- Klöckner Pentaplast

- Sealed Air

- Cosmo Films

- UFlex Limited

- Honeywell International Inc.

- TOPPAN Inc.

- ACG

- West Pharmaceutical Services, Inc.

- Tekni-Plex, Inc.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The barrier films for pharmaceutical packaging market is set for steady growth, driven by rising demand for drug safety, extended shelf life, and compliance with stringent regulatory standards. Innovations in multilayer films, high-performance materials, and sustainable packaging solutions are expected to continue shaping market dynamics, ensuring broader adoption across the pharmaceutical industry globally.