Barley Market Dynamics: Demand, Supply, and Pricing Trends

The global barley market is poised for steady growth over the forecast period, supported by its expanding role in brewing, distilling, and livestock feed production.

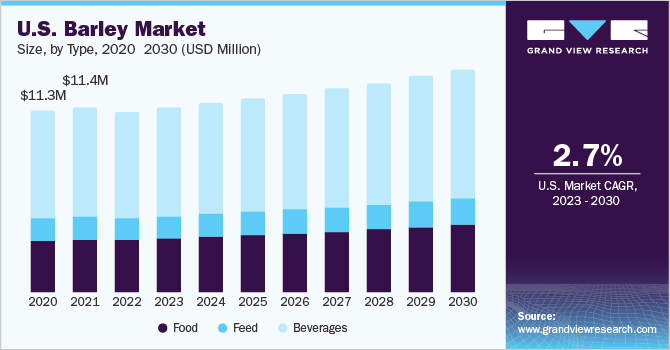

The global barley market size was estimated to be USD 140.45 billion in 2022 and is expected to reach USD 175.8 billion by 2030, growing at a compound annual growth rate (CAGR) of 2.9% from 2023 to 2030. The growth of the barley market is primarily driven by the increasing utilization of barley in the brewing and distilling industries, along with the rising demand for malted barley across diverse food and beverage applications.

The high consumption of alcoholic beverages, including craft beer and premium spirits, continues to fuel market expansion. This rising demand in the beverage sector significantly boosts barley consumption globally.

Barley also serves as a crucial feed ingredient for livestock, particularly in the production of animal feed for poultry, pigs, and cattle. The increasing demand for meat and dairy products, especially in developing economies, is propelled by population growth and rising disposable incomes, thereby driving the need for barley as a feed grain. According to the USDA, approximately 70% of barley traded is primarily used in the feed industry, while a smaller share is directed toward human consumption.

In the UK market, Switzerland-based Syngenta offers a hybrid feed barley variety called Colossus, which enhances the performance and yield of barley grains.

The unique combination of starch and protein in barley provides a balanced nutrient profile for animals, offering both energy and protein to support growth, milk production, and overall animal health. Its relatively high energy density ensures efficient feed utilization, promoting optimal livestock productivity.

Additionally, barley’s adaptability to diverse pedo-climatic conditions increases its value as a feed grain. Its resilience allows it to thrive in regions where other cereal crops may face challenges, ensuring consistent availability across different geographies.

Key Market Trends & Insights

- Europe market held a dominant revenue share of 59.9% in 2022.

- By type, the malted barley segment accounted for the largest share of 56.3% in terms of revenue in 2022.

- By application, the beverage segment held the largest share of 50.4% in terms of revenue in 2022.

- By distribution channel, the food & beverage segment captured the largest revenue share of 79.6% in 2022.

Download a free sample PDF of the Barley Market Intelligence Study, published by Grand View Research.

Market Performance

- 2022 Market Size: USD 140.45 Billion

- 2030 Projected Market Size: USD 175.8 Billion

- CAGR (2023–2030): 2.9%

- Europe: Largest market in 2022

Competitive Landscape

The global barley market is characterized by intense competition, driven by the presence of multiple established players. Companies are actively focusing on product innovation and sustainability to meet evolving consumer needs.

For instance, in May 2022, Muntons Plc announced the utilization of 100% environmentally sustainable malt derived from British barley and wheat. This innovation enables manufacturers to produce plant-based burgers, sausages, and sliced deli beef offerings from barley, aligning with the growing trend toward sustainable and plant-based foods.

Key Companies

- Soufflet Group

- GrainCorp Limited

- Cargill

- Boortmalt Group

- Malteurop Groupe

- Crisp Malting Group

- Muntons Plc

- Maltexco S.A.

- Grain Millers Inc

- Malt Products Corp

- Bries Malt & Ingredients Co.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global barley market is poised for steady growth over the forecast period, supported by its expanding role in brewing, distilling, and livestock feed production. Rising consumer preference for craft beverages, coupled with the growing demand for nutrient-rich animal feed, continues to strengthen market prospects. Additionally, advancements in hybrid barley varieties and a growing emphasis on sustainability and plant-based innovations are expected to create new opportunities for market players. As key regions like Europe maintain dominance, strategic innovations and sustainable practices will be central to long-term market success.