Barley Market 2030: Consumer Preferences and Market Demand

The global barley market was valued at USD 140.45 billion in 2022 and is projected to reach USD 175.8 billion by 2030.

The global barley market was valued at USD 140.45 billion in 2022 and is projected to reach USD 175.8 billion by 2030, expanding at a CAGR of 2.9% between 2023 and 2030. Market growth is largely supported by the increasing use of barley in the brewing and distilling industries, along with rising demand for malted barley across a wide range of food and beverage applications.

Growing consumption of alcoholic beverages, particularly craft beer and premium spirits, is a key factor contributing to market expansion. This trend has significantly increased the demand for barley within the food and beverage sector. In addition to its role in beverage production, barley remains a critical component of livestock feed. It is widely used in animal feed formulations for poultry, pigs, and cattle. Rising consumption of meat and dairy products—especially in developing economies driven by population growth and increasing income levels—has further strengthened demand for barley as a feed grain. According to the USDA, nearly 70% of globally traded barley is utilized by the feed industry, while a comparatively smaller share is consumed as human food. In this context, Switzerland-based Syngenta has introduced a hybrid feed barley variety, Colossus, in the UK market, designed to improve grain performance.

Barley offers a well-balanced nutritional profile due to its combination of starch and protein, making it a preferred ingredient in animal diets. It provides both energy and protein required to support livestock growth, milk production, and overall animal health. Its relatively high energy density enables efficient feed utilization, thereby improving animal productivity. Moreover, barley’s ability to adapt to a wide range of pedo-climatic conditions enhances its appeal as a feed crop, allowing cultivation in regions where other cereal grains may be less viable and ensuring consistent feed grain availability.

Order a free sample PDF of the Barley Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: Europe accounted for the largest share of the global barley market in 2022, capturing 59.9% of total revenue. The growing popularity of craft beer and artisanal spirits across the region has supported this dominance. The increasing number of microbreweries, brewpubs, and small-scale distilleries has driven strong demand for high-quality barley to support specialty beverage production.

- Type Insights: The malted barley segment led the market in 2022, holding a revenue share of 56.3%. The expansion of artisanal and craft beverage production has significantly boosted demand for malted barley, which enhances flavor and texture in beverages such as beer and whiskey. In March 2021, Southern Health Foods Pvt Ltd launched a malted food drink fortified with essential vitamins and minerals, highlighting the growing application of malted barley beyond alcoholic beverages.

- Application Insights: The beverage segment dominated the market by application, accounting for 50.4% of total revenue in 2022. Barley producers are increasingly adopting advanced breeding techniques and innovative technologies, including hybrid barley varieties, improved malting characteristics, and genomic tools, to meet beverage industry requirements. Hybrid varieties developed through controlled crossbreeding offer improved yields, enhanced disease resistance, and greater tolerance to environmental stress, contributing to higher barley availability. In December 2022, Brazil-based beer brand Petra introduced Petra Milk, a barley-based milk beverage.

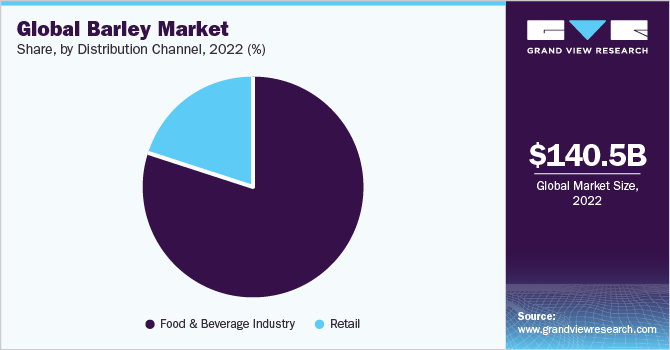

- Distribution Channel Insights: The food and beverage distribution channel held the largest revenue share of 79.6% in 2022. The rising adoption of plant-based and vegetarian diets has increased demand for barley-based food products. Barley is widely used in plant-based protein bowls, grain salads, veggie burgers, and other meat alternatives due to its nutritional value, texture, and versatility.

Market Size & Forecast

- 2022 Market Size: USD 140.45 Billion

- 2030 Projected Market Size: USD 175.8 Billion

- CAGR (2023-2030): 2.9%

- Europe: Largest market in 2022

Key Companies & Market Share Insights

The global barley market is highly competitive, with numerous players focusing on product innovation to address evolving consumer preferences. Companies are increasingly introducing sustainable and value-added barley-based products. For instance, in May 2022, Muntons Plc announced the use of 100% environmentally sustainable malt derived from British barley and wheat to support the development of plant-based products such as burgers, sausages, and sliced deli-style alternatives.

Key Players

- Soufflet Group

- GrainCorp Limited

- Cargill

- Boortmalt Group

- Malteurop Groupe

- Crisp Malting Group

- Muntons Plc

- Maltexco S.A.

- Grain Millers Inc

- Malt Products Corp

- Bries Malt & Ingredients Co.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global barley market is expected to experience steady growth through 2030, driven by strong demand from the brewing, distilling, animal feed, and food industries. Rising consumption of craft and premium beverages, increasing livestock production, and growing interest in plant-based diets are key factors shaping market expansion. With Europe maintaining its leadership position and ongoing innovations in barley breeding and sustainable product development, the market is well positioned for continued growth over the forecast period.