Automotive Composite Market 2033: A Deep Dive into Structural Applications

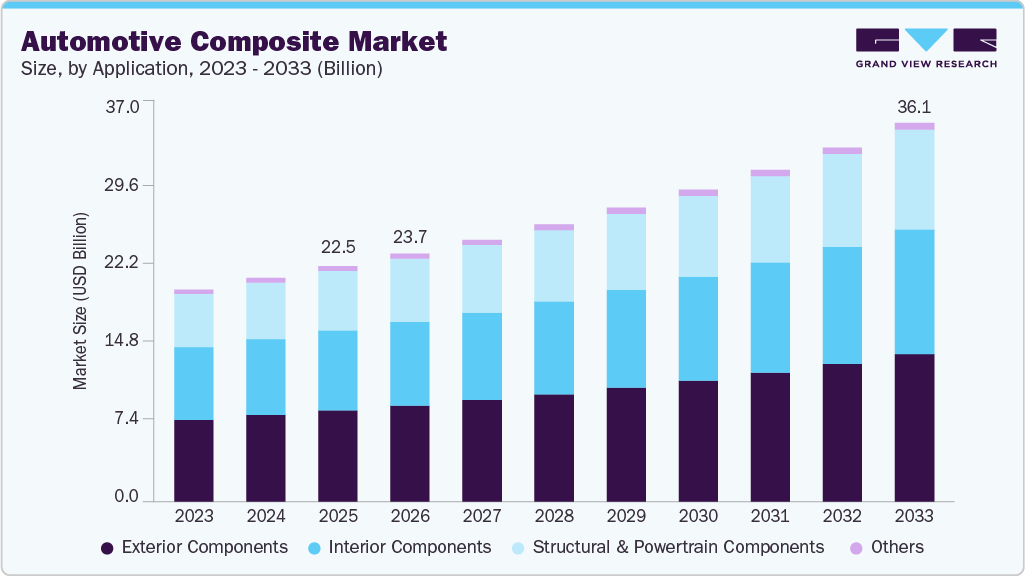

The global automotive composite market was valued at USD 21.33 billion in 2024 and is projected to reach USD 36.13 billion by 2033.

The global automotive composite market was valued at USD 21.33 billion in 2024 and is projected to reach USD 36.13 billion by 2033, growing at a CAGR of 6.1% from 2025 to 2033. This growth is being driven primarily by increasingly strict global emission regulations, which are compelling automotive manufacturers to adopt materials that support sustainable vehicle production and operation.

Composites are instrumental in reducing emissions during both the manufacturing and usage stages of a vehicle’s lifecycle. In response to environmental policies and regulatory pressure, automakers are integrating composites into exterior panels, under-the-hood components, and structural parts. This shift is significantly contributing to the market’s growth.

With the continued global movement toward electric vehicles (EVs) and hybrid technologies, composites are becoming essential in addressing the weight and thermal challenges posed by battery systems. These lightweight yet durable materials not only extend vehicle range but also provide greater design flexibility and improved thermal management. As EV adoption accelerates worldwide, the demand for composites is expected to rise accordingly.

Advancements in composite manufacturing technologies—such as automated fiber placement, resin transfer molding, and 3D printing—are further supporting market expansion by lowering costs and reducing production cycles. Additionally, the development of hybrid composites and recyclable thermoplastic composites is enhancing material performance in terms of strength, impact resistance, and sustainability. As a result, composites are no longer limited to luxury and high-performance vehicles but are being adopted across mainstream passenger and commercial automotive segments.

Order a free sample PDF of the Automotive Composite Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Asia Pacific led the global automotive composite market with a 50.8% revenue share in 2024. The region benefits from a robust automotive manufacturing sector, particularly in countries like India, Japan, South Korea, and Southeast Asia, where demand for fuel-efficient and lightweight vehicles is driving composite adoption.

- By product type, polymer matrix composites (PMCs) dominated with a 74.92% market share in 2024. These composites, typically reinforced with glass or carbon fibers, offer high mechanical strength, corrosion resistance, and design versatility, making them ideal for a wide range of automotive applications.

- By application, exterior components held the largest share of 38.78% in 2024, reflecting the growing importance of lightweight and aerodynamic vehicle design. Materials such as carbon fiber-reinforced polymers (CFRP) and glass fiber-reinforced plastics (GFRP) are commonly used for body panels, bumpers, hoods, and fenders due to their excellent strength-to-weight ratio.

Market Size & Forecast

- 2024 Market Size: USD 21.33 Billion

- 2033 Projected Market Size: USD 36.13 Billion

- CAGR (2025-2033): 6.1%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Several key players are actively shaping the automotive composite market landscape:

- Solvay (Belgium) is a global leader in advanced materials and specialty chemicals. Its extensive portfolio includes thermoplastic and thermoset composites used in structural, powertrain, and interior applications. Solvay’s solutions support both conventional and electric vehicles in meeting emission and sustainability goals.

- Toray Industries, Inc. (Japan) is a prominent manufacturer of carbon fiber and composite materials. Its offerings—such as CFRP, thermoplastic composites, and prepregs—are widely applied in vehicle body structures, chassis parts, and battery enclosures to reduce weight and enhance performance.

- SGL Carbon (Germany) is known for its carbon-based materials used in mobility and energy sectors. In automotive, it provides non-crimp fabrics and composite parts integrated into structural components such as cross beams and battery housings, especially for electric and premium vehicles.

- Teijin Limited (Japan) is a materials innovator focused on automotive composites. It manufactures carbon and aramid fiber materials for use in exterior, interior, and structural vehicle parts. Teijin emphasizes recyclability and sustainable manufacturing, aligning with industry trends toward eco-friendly solutions.

Key Players

- Solvay

- Toray Industries, Inc.

- SGL Carbon

- Teijin Limited

- Hexcel Corporation

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Johns Manville

- Gurit

- Plasan Carbon Composites

- TPI Composites

- GMS Composites

- IDI Composites International

- Revchem Composites

- Formaplex

- Owens Corning

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global automotive composite market is poised for steady growth, driven by environmental regulations, advancements in EV technology, and innovations in manufacturing processes. The increasing use of lightweight, high-strength composites in both traditional and electric vehicles highlights their importance in achieving fuel efficiency, emissions reduction, and design flexibility. With rising adoption across diverse vehicle segments and expanding applications, composite materials are becoming a cornerstone of the future automotive landscape.