Australia Vehicle Financing Market Size, Share, Report 2025-2033

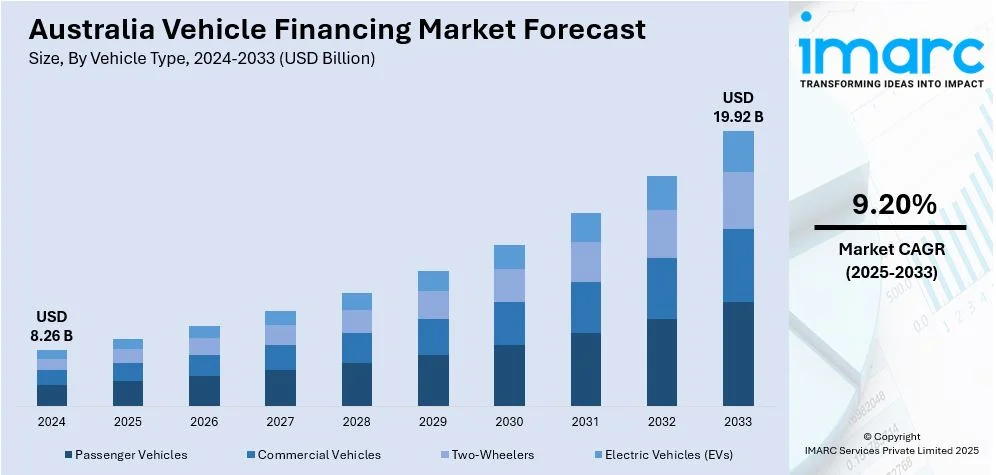

The Australia vehicle financing market reached USD 8.26 Billion in 2024 and is projected to grow to USD 19.92 Billion by 2033.

Market Overview

The Australia vehicle financing market reached USD 8.26 Billion in 2024 and is projected to grow to USD 19.92 Billion by 2033. The market is experiencing significant transformation driven by digital innovation, increased demand for used vehicles, and the transition toward electric mobility. Financing has become more accessible with flexible terms adjusted for electric vehicles and used cars, supported by efficient digital platforms and growing consumer engagement nationwide.

How AI is Reshaping the Future of Australia vehicle financing market:

- AI-powered credit scoring and biometric authentication are enhancing the digital loan processing experience, enabling instant loan approvals and reducing processing times, which improves customer satisfaction.

- The Australian Securities and Investments Commission (ASIC) has reviewed motor finance lenders to strengthen consumer protections, benefiting vulnerable populations, including regional and First Nations communities.

- AI-driven digital platforms facilitate remote finance applications, supporting a wider range of customers, such as first-time buyers and rural consumers, increasing financing accessibility.

- Financial institutions are developing AI-enabled EV-focused loan products with customized interest rates and longer repayment periods to lower the cost barrier for electric vehicles.

- Integration of AI in vehicle inspection and certification processes improves consumer confidence in financing used and certified pre-owned vehicles.

- AI-powered peer-to-peer lending and crowd-based platforms are democratizing vehicle financing by connecting borrowers directly with investors, offering flexible and competitive lending options.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-vehicle-financing-market/requestsample

Market Growth Factors

The vehicle finance industry in Australia is increasing because of urban growth and increased demand for vehicle ownership. Population growth and urban sprawl (suburban and regional areas without a developed public transport system) have made vehicle ownership necessary to access education and gain employment in Australia. As the need for affordable financing which can be paid in installments instead of making large down payments on vehicles increases, vehicle loans, leasing and other financing products are becoming popular as they meet the mobility needs of this larger and more diverse population and driving the vehicle financing market.

Short-term low interest rates have helped the market by reducing the cost of car loans to Australian consumers, allowing buyers to upgrade to higher specification and newer vehicles and having a positive impact on first and younger buyers who are more sensitive to monthly repayments. The low rates, along with periods of promotional rates and dealer incentives, have had a lasting impact on demand for new and used cars, and have contributed to the rapid growth in the financing market.

Also fueling the growth of the market is the provision of financing services through Australian car dealerships. Most Australian car dealerships now provide their customers with integrated loans through partnerships with banks, credit unions and non-bank lenders. Point-of-sale finance services offer flexible terms, on-the-spot finance and purchase approvals, and bundle and promotional offers. These services aim to increase conversions at dealerships, increasing the number of Australians using point-of-sale finance to buy a vehicle rather than paying for it upfront.

Australia Vehicle Financing Market Segmentation

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Electric Vehicles (EVs)

Loan Provider Insights:

- Banks

- Non-Banking Financial Companies (NBFCs)

- Original Equipment Manufacturers (OEMs) Financing

- Credit Unions

- Others

Vehicle Condition Insights:

- New Vehicles

- Used Vehicles

Purpose Type Insights:

- Loan

- Leasing

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Key Players

- Allied Credit

- Chery Australia

- CommBank

- NAB

- Plenti

Recent Development & News

- July 2024: Allied Credit and Chery Australia launched an ongoing finance alliance under the Chery Motor Finance marque, offering customer-centric new vehicle financing programs including guaranteed future value, enhancing ownership experiences nationwide.

- April 2024: CommBank partnered with carsales and Vyro to introduce a car purchase service through its app, featuring vehicle searching, finance approval, and management, with special electric vehicle discounts to target environmentally conscious consumers.

- April 2025: Government-backed financial literacy initiatives gained momentum, empowering consumers to make informed vehicle financing decisions, particularly benefiting first-time buyers and enhancing overall market stability and growth.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

https://www.imarcgroup.com/request?type=report&id=35119&flag=F

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302