Australia Private Equity Industry Trends, Share, Size and Forecast | 2025-2033

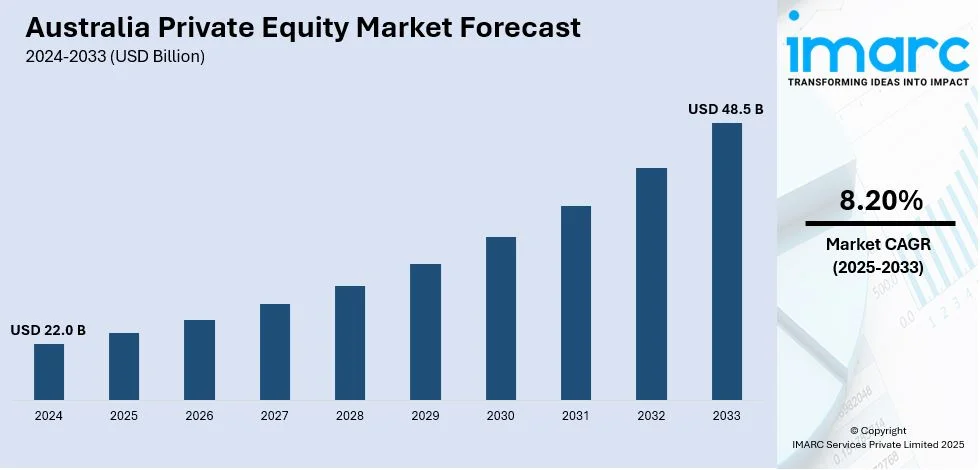

The Australia private equity market was valued at USD 22.0 Billion in 2024, expected to reach USD 48.5 Billion by 2033, growing at a CAGR of 8.20%.

The latest report by IMARC Group, titled "Australia Private Equity Market: Industry Trends, Share, Size, Growth, Opportunity, and Forecast 2025-2033," offers a comprehensive analysis of the Australia private equity market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia private equity market size reached USD 22.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 48.5 Billion by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033.

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 22.0 Billion

Market Forecast in 2033: USD 48.5 Billion

Market Growth Rate 2025-2033: 8.20%

Australia Private Equity Market Overview

The Australian private equity market is going through major changes as investors are slowly putting more money into fast-growing areas like technology, healthcare, and clean energy. Companies are using better data tools, digital platforms, and new investment methods to find and take advantage of emerging opportunities. Government policies are helping businesses and infrastructure grow, while institutional investors are increasing their investments in private equity. The market is also seeing more international activity and strong partnerships, which is helping it stay a major player in the Asia-Pacific investment area.

Request For Sample Report: https://www.imarcgroup.com/australia-private-equity-market/requestsample

Australia Private Equity Market Growth Trends

Members of the showcase are getting mechanical progressions, counting fake insights and huge information analytics, to improve consistency and portfolio management. Key partnerships between private value firms and local businesses are helping them reach modern markets and improve operational efficiency. Changes in administration and favorable tax policies are helping both local and external investments, while sustainability and ESG factors are becoming essential in investment decisions. The sector is also benefiting from strong fundraising activities and creative deal structures, supporting continued growth.

Australia Private Equity Market Growth Drivers

Private companies are focusing on building their reputation by improving their operations, using technology, and specializing in certain areas. The market is seeing more investments in real assets, driven by growing cities and an increasing population. Companies with pension funds and international investors are putting in more money, while government-backed projects are helping new businesses grow. The emphasis on responsible investing and using smart investment methods is changing how the market works, making it more flexible and able to grow over time.

Australia Private Equity Market Segmentation:

By Fund Type: o Buyout o Venture Capital o Real Estate o Infrastructure o Others

By Region: o Australia Capital Territory & New South Wales o Victoria & Tasmania o Queensland o Northern Territory & Southern Australia o Western Australia

Australia Private Equity Market News:

o In December 2024, ISPT merged with IFM Investors to accelerate growth strategies in real estate and infrastructure.

o In early 2025, Rest committed USD 300 million to infrastructure investments, highlighting increased institutional participation.

Key Highlights of the Report:

o Market Performance (2019-2024) o Market Outlook (2025-2033) o COVID-19 Impact on the Market o Porter's Five Forces Analysis o Strategic Recommendations o Historical, Current and Future Market Trends o Market Drivers and Success Factors o SWOT Analysis o Structure of the Market o Value Chain Analysis o Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=31707&flag=E

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA Email: sales@imarcgroup.com Tel No: (D) +91 120 433 0800 United States: +1-631-791-1145