Australia Organic Baby Skincare Market Projected to Reach USD 137.59 Million by 2033

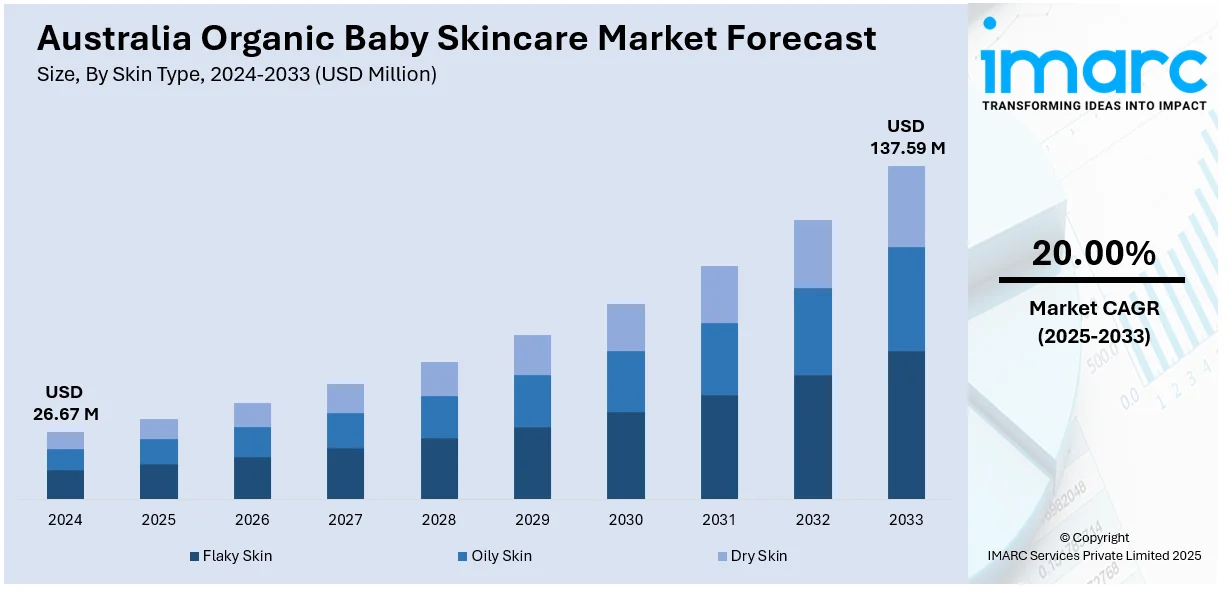

Australia organic baby skincare market size reached USD 26.67 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 137.59 Million by 2033, exhibiting a CAGR of 20.00% during 2025-2033.

The latest report by IMARC Group, titled "Australia Organic Baby Skincare Market Report by Skin Type (Flaky Skin, Oily Skin, Dry Skin), Product Type (Baby Oil, Baby Powder, Baby Soaps, Petroleum Jelly, Baby Lotion, Others), Distribution Channel (Hypermarkets and Supermarkets, E-Commerce, Specialty Stores, Retail Pharmacies, Convenience Stores), and Region 2025-2033," offers comprehensive analysis of the Australia organic baby skincare market growth. The report includes competitor and regional analysis, along with detailed breakdown of the market segmentation. The Australia organic baby skincare market size reached USD 26.67 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 137.59 Million by 2033, exhibiting a CAGR of 20.00% during 2025-2033.

Base Year: 2024 Forecast Years: 2025-2033 Historical Years: 2019-2024 Market Size in 2024: USD 26.67 Million Market Forecast in 2033: USD 137.59 Million Market Growth Rate (2025-2033): 20.00%

Australia Organic Baby Skincare Market Overview

The Australia organic baby skincare market is experiencing exceptional growth fueled by escalating consumer demand for safe, natural products free from harmful chemicals, heightened environmental awareness driving sustainable purchasing decisions, strong preference for eco-friendly and sustainable packaging solutions, expanding recognition of ingredient transparency importance in product selection, and increasing emphasis on product integrity and ethical manufacturing practices. The market transformation reflects parents' growing concern about long-term effects of synthetic chemicals on delicate baby skin, leading to accelerated adoption of certified organic formulations containing plant-derived ingredients without parabens, sulfates, or synthetic fragrances. Consumer priorities have shifted decisively toward products offering superior safety profiles, particularly for babies with sensitive skin or eczema conditions, supported by transparent labeling practices that enable informed purchasing decisions and build trust in organic baby skincare brands.

Australia's organic baby skincare industry demonstrates robust momentum through certified organic ingredient demand acceleration, sustainable packaging and eco-friendliness integration, digital awareness and e-commerce growth enabling widespread product accessibility, and health-conscious parenting culture emphasizing natural, cruelty-free, ethically sourced products. The market maintains critical importance across diverse product categories including baby oils, baby powders, baby soaps, petroleum jelly, baby lotions, and specialized formulations addressing specific skin types encompassing flaky skin, oily skin, and dry skin conditions. The proliferation of biodegradable packaging innovations, recyclable and refillable container designs, online retail platform expansion, social media-driven product discovery, and official organic certification adoption is creating favorable market conditions, requiring substantial investments in sustainable manufacturing processes, ingredient traceability systems, digital marketing capabilities, and transparency-focused brand positioning. Australia's strategic focus on environmental stewardship, combined with zero-waste and low-impact living societal shifts, makes it an increasingly dynamic market for organic baby skincare innovation and sustainable product development leadership.

Request For Sample Report: https://www.imarcgroup.com/australia-organic-baby-skincare-market/requestsample

Australia Organic Baby Skincare Market Trends

• Growing demand for certified organic ingredients: Increased parental awareness of synthetic chemical effects driving adoption of products formulated without parabens, sulfates, or synthetic fragrances, featuring certified organic, plant-derived ingredients supporting health-conscious parenting and natural living philosophies.

• Impact of sustainable packaging and eco-friendliness: Visible trend toward environmentally responsible packaging including biodegradable, recyclable, and refillable solutions with green innovations like compostable tubes, glass containers, and minimalist plastic-free designs resonating with eco-conscious consumers.

• Digital awareness and e-commerce growth: Expanding online product discovery through e-commerce websites, social media platforms, and parenting communities enabling extensive range access, doorstep delivery convenience, ingredient transparency emphasis, and product traceability appeal to health-aware consumers.

• Health-conscious parenting culture: Rising emphasis on product safety, natural formulations, and cruelty-free, ethically sourced ingredients reflecting broader organic living movement with parents equating certified organic products with superior quality and skin suitability for sensitive conditions.

• Ingredient transparency prioritization: Consumer demand for clear labeling, complete ingredient disclosure, and product origin information driving brand differentiation through traceability systems, certification displays, and detailed formulation explanations building trust and informed decision-making.

• Sustainability and brand integrity alignment: Growing consumer association between environmental responsibility and product quality positioning sustainable packaging as critical differentiator with zero-waste, low-impact living values influencing purchasing decisions in competitive organic baby skincare landscape.

Market Drivers

• Synthetic chemical awareness: Heightened parental concern about long-term synthetic chemical effects on delicate baby skin driving preference for natural, organic formulations particularly for infants with sensitive skin, eczema, or allergic conditions requiring gentler product alternatives.

• Environmental consciousness: Expanding societal awareness of environmental impact and sustainability issues motivating parents to seek products benefiting children's health while contributing positively to planetary wellbeing through eco-friendly packaging and ethical manufacturing practices.

• Organic living movement: Broader national trend toward organic lifestyle adoption across food, household products, and personal care categories extending to baby skincare with consumers prioritizing natural, chemical-free alternatives aligned with holistic health philosophies.

• E-commerce accessibility: Digital platform proliferation enabling easy product discovery, comparison shopping, review access, and convenient home delivery expanding organic baby skincare reach beyond urban centers to regional and remote areas previously underserved by specialty retail.

• Certification and quality assurance: Official organic certifications providing independent verification of product claims building consumer confidence in formulation integrity, ingredient sourcing practices, and manufacturing standards differentiating genuine organic products from conventional alternatives.

• Sensitive skin prevalence: Growing recognition of baby skin sensitivity issues and conditions like eczema, dermatitis, and allergic reactions driving demand for hypoallergenic, gentle formulations with certified organic ingredients minimizing irritation risks and supporting skin health.

Challenges and Opportunities

Challenges:

- Premium pricing barriers with certified organic baby skincare products commanding higher price points compared to conventional alternatives limiting accessibility for price-sensitive consumers and restricting market penetration across broader socioeconomic segments

- Certification complexity and costs associated with obtaining and maintaining organic certifications creating entry barriers for small producers and independent brands while requiring ongoing compliance investments for ingredient sourcing and manufacturing processes

- Limited retail distribution with organic baby skincare products concentrated in specialty stores and select retailers reducing physical product accessibility and testing opportunities compared to widely available conventional baby care brands in mainstream retail channels

- Consumer education requirements addressing knowledge gaps about organic certification standards, ingredient benefits, and product efficacy necessitating significant marketing investments to communicate value propositions and justify premium pricing to skeptical consumers

- Supply chain constraints for certified organic ingredients experiencing limited availability, seasonal variations, and higher costs impacting production scalability, product consistency, and competitive pricing strategies for manufacturers expanding product ranges

Opportunities:

- Sustainable packaging innovation developing advanced biodegradable materials, compostable tubes, refillable systems, and minimalist plastic-free designs appealing to environmentally conscious consumers while differentiating brands through visible commitment to environmental stewardship

- E-commerce expansion leveraging digital platforms, social media marketing, influencer partnerships, and direct-to-consumer models enabling niche organic brands to reach broader audiences, build communities, and compete effectively against established conventional brands

- Product line diversification creating specialized formulations addressing specific skin conditions, age ranges, and seasonal needs with organic ingredients targeting flaky skin, oily skin, dry skin, eczema-prone skin, and newborn-specific requirements expanding market coverage

- Regional market penetration utilizing online distribution channels and targeted marketing campaigns to reach underserved regional and remote areas where specialty retail presence is limited but digital connectivity and organic lifestyle adoption are growing

- Certification transparency initiatives highlighting organic certifications, ingredient sourcing stories, sustainability commitments, and ethical manufacturing practices through enhanced labeling, digital traceability tools, and brand storytelling building consumer trust and premium positioning

Australia Organic Baby Skincare Market Segmentation

By Skin Type:

- Flaky Skin

- Oily Skin

- Dry Skin

By Product Type:

- Baby Oil

- Baby Powder

- Baby Soaps

- Petroleum Jelly

- Baby Lotion

- Others

By Distribution Channel:

- Hypermarkets and Supermarkets

- E-Commerce

- Specialty Stores

- Retail Pharmacies

- Convenience Stores

By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Browse Full Report: https://www.imarcgroup.com/australia-organic-baby-skincare-market

Australia Organic Baby Skincare Market News (2024)

• June 2024: Pod Organics received Best Natural Baby Brand Australia award for second consecutive year with four Everyday Essentials products winning awards at Beauty Shortlist Mama and Baby Awards demonstrating industry recognition for organic baby skincare excellence and product quality.

• November 2024: Pampered Bee received 2024 Global Recognition Award for organic baby care excellence, acclaimed for innovation, sustainability commitment, and community involvement leadership continuing to raise industry standards for organic baby skincare products.

• 2024: E-commerce platform adoption accelerated with Australian parents increasingly utilizing online channels including specialized websites, social media platforms, and parenting communities for product discovery, review access, and doorstep delivery convenience expanding organic baby skincare accessibility.

• 2024: Sustainable packaging innovations proliferated with manufacturers introducing biodegradable materials, compostable tubes, glass containers, refillable systems, and minimalist plastic-free designs responding to environmental consciousness and zero-waste living preferences among Australian consumers.

• 2024: Organic certification adoption increased across baby skincare brands with emphasis on ingredient transparency, product traceability, and labeling clarity building consumer trust and differentiating products in competitive market emphasizing safety and natural formulations.

Key Highlights of the Report

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- Industry Catalysts and Challenges

- Segment-wise historical and future forecasts

- Competitive Landscape and Key Player Analysis

- Skin Type, Product Type, Distribution Channel, and Regional Analysis

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24668&flag=F

Q&A Section

Q1: What drives growth in the Australia organic baby skincare market? A1: Market growth is driven by synthetic chemical awareness regarding long-term effects on baby skin, environmental consciousness motivating sustainable product choices, organic living movement extending to baby care categories, e-commerce accessibility expanding product reach beyond urban centers, certification and quality assurance building consumer confidence, and sensitive skin prevalence creating demand for hypoallergenic organic formulations.

Q2: What are the latest trends in this market? A2: Key trends include growing demand for certified organic ingredients free from parabens and synthetic fragrances, sustainable packaging impact with biodegradable and refillable solutions, digital awareness and e-commerce growth enabling convenient product access, health-conscious parenting culture prioritizing natural formulations, ingredient transparency prioritization through clear labeling, and sustainability-brand integrity alignment influencing purchasing decisions.

Q3: What challenges do companies face? A3: Major challenges include premium pricing barriers limiting accessibility across socioeconomic segments, certification complexity and costs creating entry barriers for small producers, limited retail distribution reducing physical product availability, consumer education requirements necessitating marketing investments to justify premium pricing, and supply chain constraints for certified organic ingredients impacting production scalability and consistency.

Q4: What opportunities are emerging? A4: Emerging opportunities include sustainable packaging innovation with biodegradable and compostable materials, e-commerce expansion through digital platforms and direct-to-consumer models, product line diversification addressing specific skin conditions and age ranges, regional market penetration utilizing online distribution channels, and certification transparency initiatives building consumer trust through enhanced labeling and traceability.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us

IMARC Group 134 N 4th St. Brooklyn, NY 11249, USA Email: sales@imarcgroup.com Tel No: (D) +91-120-433-0800 United States: +1-201-971-6302