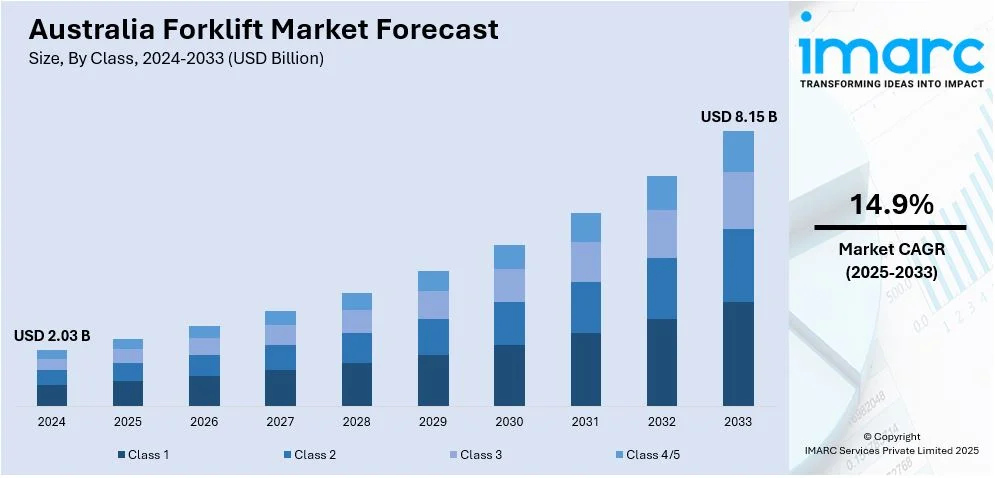

Australia Forklift Market to Reach USD 8.15 Billion by 2033

The market size reached USD 2.03 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.15 Billion by 2033, exhibiting a growth rate (CAGR) of 14.9% during 2025–203

The latest report by IMARC Group, “Australia Forklift Market Report by Class (Class 1, Class 2, Class 3, and Class 4/5), Power Source (Internal Combustion Engine (ICE), Electric), Load Capacity (Below 5 Ton, 5-15 Ton, Above 16 Ton), Electric Battery Type (Li-ion, Lead Acid), and End User (Industrial, Logistics, Chemical, Food and Beverage, Retail and E-commerce, Others) 2025–2033,” provides an in-depth analysis of the Australia forklift market. The market size reached USD 2.03 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.15 Billion by 2033, exhibiting a growth rate (CAGR) of 14.9% during 2025–2033.

Base Year: 2024 Forecast Years: 2025–2033 Historical Years: 2019–2024 Market Size in 2024: USD 2.03 Billion Market Forecast for 2033: USD 8.15 Billion Market Growth Rate 2025–2033: 14.9%

Australia Forklift Market Overview

Australia’s forklift market is gaining momentum, driven by the rise in warehouse automation, growth in e-commerce logistics, and large-scale infrastructure developments. Increasing demand from the construction and manufacturing sectors further fuels this expansion. Technological innovations—especially in electric forklifts powered by lithium-ion batteries—are supporting sustainability targets and reducing operational costs. Meanwhile, flexible service models such as rentals and maintenance-inclusive contracts are becoming increasingly attractive, helping businesses lower capital outlays and manage equipment lifecycle costs more efficiently.

Request For Sample Report: https://www.imarcgroup.com/australia-forklift-market/requestsample

Australia Forklift Market Trends

- Growing preference for electric forklifts and associated service-based deployments featuring comprehensive maintenance contracts.

- Deployment of medium- and heavy-duty forklifts, including lithium-ion variants, signaling confidence in battery technology.

- Increased imports of forklift attachments, particularly from India, supported by expanding bilateral trade agreements.

- Adoption of advanced forklift technologies and fleet management solutions enhancing efficiency and sustainability.

Australia Forklift Market Drivers

- Rising e-commerce and logistics sector fueling demand for efficient material handling equipment.

- Infrastructure projects and growing industrial activities in construction, chemical, and manufacturing sectors.

- Government incentives supporting adoption of low-emission electric forklifts.

- Emphasis on reducing workplace emissions and enhancing sustainability in material handling operations.

Challenges and Opportunities

Challenges:

- High initial capital expenditure for electric forklift technology and related infrastructure.

- Supply chain complexities for critical components, including batteries and attachments.

- Need for skilled operators and maintenance personnel trained in advanced forklift technologies.

Opportunities:

- Expansion of rental and service-based forklift deployment models reducing end-user capital costs.

- Increased production and adoption of lithium-ion battery forklifts improving operational efficiency.

- Growth in cross-border supply chains providing diverse attachment options suited to local applications.

- Enhanced fleet management and IoT integration generating operational insights and cost savings.

Government Support

- Incentives and subsidies for electric and low-emission forklifts aligning with national environmental goals.

- Supportive trade agreements enhancing import and export flows of forklift components and attachments.

- Infrastructure development grants boosting warehouse and logistics growth, thus increasing forklift demand.

- Programs encouraging adoption of sustainable industrial equipment within manufacturing and logistics sectors.

- Regulatory frameworks promoting workplace safety and emission reduction in material handling operations.

Australia Forklift Market Segmentation

By Class:

- Class 1

- Class 2

- Class 3

- Class 4/5

By Power Source:

- Internal Combustion Engine (ICE)

- Electric

By Load Capacity:

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

By Electric Battery Type:

- Lithium-ion

- Lead Acid

By End User:

- Industrial

- Logistics

- Chemical

- Food and Beverage

- Retail and E-commerce

- Others

By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/australia-forklift-market

Australia Forklift Market News (2024–2025)

- October 2024: Kalmar and BlueScope entered into a rental agreement for supply and maintenance of 13 forklifts including six lithium-ion electric models.

- 2024-2025: Growing industrial and logistics activity in Australia drives demand for medium and heavy-duty forklifts.

- Increasing bilateral trade between India and Australia benefits the supply of aftermarket forklift attachments.

- Sustainable industrial equipment adoption encouraged by government incentives and regulations.

Key Highlights of the Report

- Historical and forecast market sizing and growth (2019–2033)

- Segmentation by class, power source, load capacity, battery type, end user, and region

- Review of technology trends, government policies, and trade agreements

- Competitive landscape and market strategies of leading players

- Insights into challenges and growth opportunities in material handling sector

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=34285&flag=F

Q&A Section

Q1: What is driving growth in the Australia forklift market? A1: Rising e-commerce logistics, warehouse automation, infrastructure development, and sustainability goals are key growth drivers.

Q2: How is government support impacting the forklift market? A2: Incentives for electric forklifts, trade agreements facilitating component imports, and infrastructure funding are bolstering market growth.

Q3: What is the trend in power source preference for forklifts in Australia? A3: There is a clear transition toward electric forklifts, especially lithium-ion battery-powered models, due to environmental and cost benefits.

Q4: Which industries are the major consumers of forklifts? A4: Industrial manufacturing, logistics, chemical, food and beverage, and e-commerce retail are significant end users of forklifts.

About Us: IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The company provides a comprehensive suite of market entry and expansion services.

Contact Us: IMARC Group 134 N 4th St. Brooklyn, NY 11249, USA Email: Sales@imarcgroup.com Tel. No.: (D) +91 120 433 0800 Americas: +1-201-971-6302