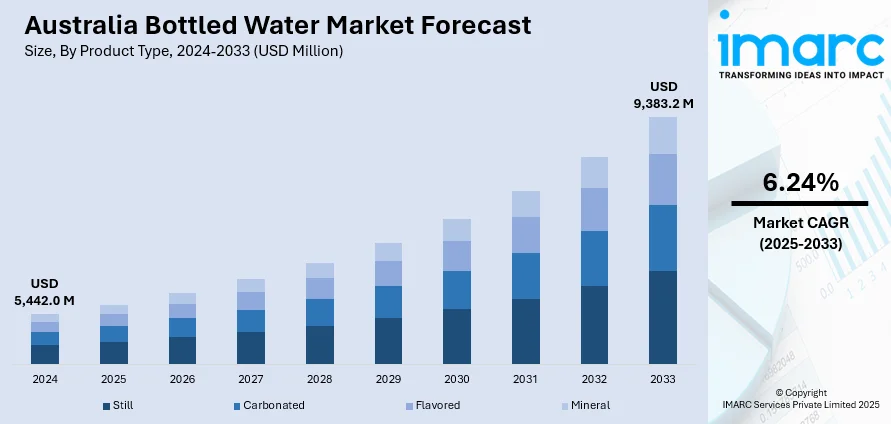

Australia Bottled Water Market Projected to Reach USD 9,383.2 Million by 2033

Australia bottled water market size reached USD 5,442.0 Million in 2024. Looking forward, the market is expected to reach USD 9,383.2 Million by 2033, exhibiting a growth rate (CAGR) of 6.24% during 2025-2033.

The latest report by IMARC Group, titled "Australia Bottled Water Market Report by Product Type (Still, Carbonated, Flavored, Mineral), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Direct Sales, On-Trade, and Others), and Region 2025-2033," provides a comprehensive analysis of the Australia bottled water market growth. The report includes detailed competitor and regional analysis, along with segmentation based on product type and distribution channels. The Australia bottled water market size reached USD 5,442.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,383.2 Million by 2033, exhibiting a growth rate (CAGR) of 6.24% during 2025–2033.

Report Attributes:

- Base Year: 2024

- Forecast Years: 2025–2033

- Historical Years: 2019–2024

- Market Size in 2024: USD 5,442.0 Million

- Market Forecast in 2033: USD 9,383.2 Million

- Market Growth Rate 2025–2033: 6.24%

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/australia-bottled-water-market/requestsample

Australia Bottled Water Market Overview

- The market is driven by the development of product variants with advanced hydration solutions such as isotonic and pH-balanced water.

- Increasing consumer health and wellness focus is steering preference toward bottled water perceived as pure, natural, and free from additives.

- Sustainability concerns are fueling innovations in eco-friendly packaging and refillable systems aligned with Australian regulations and environmental campaigns.

- Urbanization and busy lifestyles are increasing demand for convenient, on-the-go hydration options across retail, foodservice, and convenience channels.

- Tourism and outdoor events significantly contribute to demand, supporting premium and differentiated bottled water positioning.

Key Features and Trends of Australia Bottled Water Market

- Growth of functional and enhanced water segments including vitamin-enriched, electrolyte-infused, and botanically flavored products.

- Increasing collaboration with indigenous communities and emphasis on locally sourced water bolstering product authenticity.

- Rising investments in green packaging materials including recycled, biodegradable, and plant-based alternatives.

- Expansion of sustainability initiatives such as container deposit schemes and local refill programs gaining traction.

- Premiumization trend with brands emphasizing natural origin, purity, and wellness benefits to command higher prices.

Growth Drivers of Australia Bottled Water Market

- Rising health consciousness and demand for sugar-free, additive-free hydration alternatives.

- Expanding urban populations with mobile lifestyles requiring convenient bottled water options.

- Government initiatives and regulations promoting sustainable packaging and environmental responsibility.

- Expanding tourism and outdoor recreational activities boosting bottled water consumption.

- Development of new product variants catering to wellness and fitness oriented consumer segments.

Innovation & Market Demand of Australia Bottled Water Market

- The market is innovating with botanical infusions and electrolyte additives meeting modern consumer preferences.

- Sustainable packaging innovations aligned with circular economy principles are meeting regulatory and consumer demands.

- Premium and functional water variants are driving market differentiation and growth.

- Digital marketing and storytelling emphasizing provenance and health credentials amplify consumer engagement.

- Local sourcing, indigenous collaborations, and transparency are increasing brand loyalty and market penetration.

Australia Bottled Water Market Opportunities

- Expansion in functional and enhanced water segments targeting health-conscious consumers.

- Growing demand for environmentally friendly packaging and refill systems driven by policy and public focus.

- Opportunities in regional and remote areas with limited tap water access.

- Export potential into Asia-Pacific markets seeking premium, naturally sourced bottled water.

- Increased collaboration with indigenous communities for unique product differentiation.

Australia Bottled Water Market Challenges

- Environmental concerns and activism regarding plastic waste and single-use bottles pressurizing industry players.

- Competition from high-quality municipal tap water and growing public water refill infrastructure.

- Logistical challenges associated with Australia’s vast geography impacting distribution and costs.

- Balancing premium pricing with increasing consumer focus on sustainability and value.

- Regulatory compliance complexities across states posing operational and marketing challenges.

Australia Bottled Water Market Analysis

- Segmentation by product type: still, carbonated, flavored, mineral water, and others.

- Distribution channels: supermarkets and hypermarkets, convenience stores, direct sales, on-trade, and others.

- Regional segmentation includes Australian Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

- Competitive landscape with detailed profiles and strategic positioning of major players.

- Market growth driven by wellness trends, urbanization, sustainability initiatives, and premium product innovation.

Australia Bottled Water Market Segmentation:

- By Product Type:

- Still Water

- Carbonated Water

- Flavored Water

- Mineral Water

- Others

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

- By Region:

- Australian Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Bottled Water Market News & Recent Developments:

- Growing adoption of container deposit schemes in New South Wales and South Australia enhancing recycling rates in 2024.

- Expansion of plant-based packaging initiatives and refill stations in Queensland and Victoria supporting sustainability goals.

Australia Bottled Water Market Key Players:

- The Coca-Cola Company

- Asahi Holdings (Australia) Pty Ltd.

- Fruit Splash

- Beloka Water Pty Ltd.

- Neverfail Springwater Proprietary Limited

- Fiji Water Company LLC

- West Coast Spring Water Pty Ltd.

Key Highlights of the Report:

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=21988&flag=E

FAQs: Australia Bottled Water Market

Q1: What was the market size of the Australia bottled water market in 2024? A: The market size was USD 5,442.0 Million in 2024.

Q2: What growth rate is expected for the Australia bottled water market? A: The market is projected to grow at a CAGR of 6.24% during 2025–2033.

Q3: What factors are driving growth in the bottled water market? A: Health consciousness, urban lifestyles, tourism, and product innovation are main drivers.

Q4: Which packaging trends are influencing the Australia bottled water market? A: Sustainability-driven packaging, biodegradable and recycled materials, and refill programs are shaping the market.

Q5: Who are the key players in the Australia bottled water market? A: The Coca-Cola Company, Asahi Holdings, Fruit Splash, Neverfail Springwater, Fiji Water, and others are key players.

About Us: IMARC Group is a leading global market research company that provides management strategy and market research worldwide. We partner with clients to identify opportunities, tackle challenges, and transform businesses with actionable insights.

Contact Us: 134 N 4th St. Brooklyn, NY 11249, USA Email: sales@imarcgroup.com Tel No: (D) +91 120 433 0800 United States: +1-201971-6302