Anti-obesity Medication Market Key Players Driving Market Trends

The anti-obesity medication market is set for substantial growth, driven by rising global obesity rates and advancements in drug innovation. Increased R&D investments and the introduction of next-generation therapies are expanding treatment possibilities.

The global anti-obesity medication market size was estimated at USD 6.62 billion in 2023 and is expected to reach USD 77.24 billion by 2030, growing at a CAGR of 31.66% from 2024 to 2030. Increasing awareness of the health risks linked to being overweight is a major factor driving market growth.

The acceleration in the development of anti-obesity drugs, supported by strong R&D investments, is further fueling market expansion. Advances in drug development technologies are enabling the creation of more effective treatments, meeting the rising demand to address overweight-related health challenges.

Market participants are investing heavily in clinical research to bring forward innovative therapies. In August 2022, Novo Nordisk completed a phase 2 clinical trial for CagriSema, demonstrating its potential benefits for individuals with type 2 diabetes and overweight. Other drugs such as Oral Sema Obesity (phase 3) and GELA, INV-202 (phase 2) also show promise in expanding treatment options. Similarly, in June 2023, Eli Lilly’s phase 2 trial of orforglipron revealed significant weight loss and improved A1C outcomes in adults with obesity or type 2 diabetes. If phase 3 trials confirm these results, it could broaden therapeutic choices and intensify market competition.

The launch of new drugs like CagriSema, Oral Sema Obesity, GELA, INV-202, and orforglipron is significantly boosting market growth. Companies that focus on innovation and commercialization of advanced medications are likely to secure a competitive edge and establish stronger market positions.

Key Market Highlights:

- North America dominated the market with a revenue share of 37.67% in 2023.

- By product, the approved product segment held the largest share in 2023 and is projected to grow at a CAGR of 32.41% from 2024 to 2030.

- By mechanism of action, the peripherally acting anti-obesity drugs segment accounted for the largest share of 59.87% in 2023.

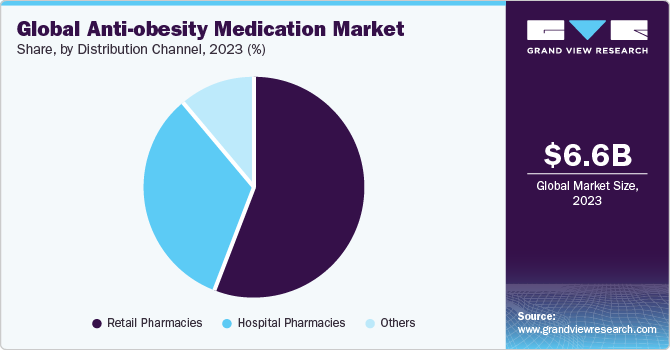

- By distribution channel, the retail pharmacies segment led the market in 2023 with a share of 55.90%.

Download a free sample PDF of the Anti-obesity Medication Market Intelligence Study from Grand View Research.

Market Performance:

- 2023 Market Size: USD 6.62 Billion

- 2030 Projected Market Size: USD 77.24 Billion

- CAGR (2024–2030): 31.66%

- North America: Largest market in 2023

Prominent Companies & Market Dynamics:

Leading players in the market include Novo Nordisk A/S, GlaxoSmithKline plc, Novartis AG, VIVUS LLC, Currax Pharmaceuticals, and Kintai Therapeutics. These companies are focusing on strategies such as product approvals, partnerships, collaborations, and regional expansion to strengthen their positions. For example, expanding into emerging economies through agreements with local players is a key growth strategy.

Emerging participants like Rhythm Pharmaceuticals, Inc. and Boehringer Ingelheim International GmbH are pursuing strategic initiatives, including partnerships and collaborations, to enhance their footprint. They are also focusing on niche supply chain areas such as distribution and product delivery solutions to establish competitive advantages.

Key Companies:

- Novo Nordisk A/S

- GlaxoSmithKline plc

- Novartis AG

- VIVUS LLC

- Currax Pharmaceuticals

- Kintai Therapeutics

- Boehringer Ingelheim International GmbH

- Rhythm Pharmaceuticals, Inc.

- Gelesis

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The anti-obesity medication market is set for substantial growth, driven by rising global obesity rates and advancements in drug innovation. Increased R&D investments and the introduction of next-generation therapies are expanding treatment possibilities. North America currently leads the market, while other regions are expected to witness strong growth due to rising healthcare awareness. Strategic collaborations, product launches, and regulatory approvals are shaping the competitive landscape. As more effective drugs reach the market, opportunities for both established and emerging players are expected to grow significantly.