Africa Health Insurance Market Key Players Redefining Affordability

The Africa health insurance market is poised for strong growth, driven by rising healthcare costs, increasing use of telemedicine, and supportive regulatory reforms.

The Africa health insurance market size was valued at USD 28.3 billion in 2022 and is anticipated to reach USD 50.3 billion by 2030, growing at a CAGR of 5.26% from 2023 to 2030. Demand for health insurance in the region is being driven by the rising cost of medical services and an increase in daycare procedures. In South Africa, medical scheme inflation is often higher than the Consumer Price Index (CPI), causing private healthcare costs to rise faster than wage growth.

In Q1 2023, the African health insurance sector continued to face challenges from the economic consequences of COVID-19 and broader financial stress. Struggling companies and individuals have pressured insurers, leading to low volumes and reduced profitability for new business. To adapt, insurers have introduced innovative products, bridging gaps between funeral coverage and underwritten policies, while also launching new coverage options.

The growing adoption of telemedicine is expected to significantly boost market expansion. According to the UNDP Insurance and Risk Finance report, telemedicine could provide affordable health insurance to 186 million people in sub-Saharan Africa—over half of the population currently lacking access to healthcare. If affordability thresholds are met, as many as 343 million individuals could be insured at an estimated annual cost of USD 25 billion.

The African insurance industry is also experiencing rapid innovation and disruption, as competition drives insurers to leverage technology, reduce costs, and target niche markets. For example, Blue Wave in Kenya offers micro-insurance products via mobile platforms, making coverage accessible to the mass market in East Africa.

In addition, governments across Africa are strengthening regulations and capital requirements to ensure the solvency and sustainability of insurers. These reforms are expected to foster stronger companies, create more jobs, and build consumer trust and public awareness, ultimately supporting long-term market growth.

Key Market Insights

- By distribution channel: The brokers and individual agents segment held the largest revenue share of 67.54% in 2022, as agents can provide tailored solutions by assessing both life and health insurance needs in line with personal circumstances.

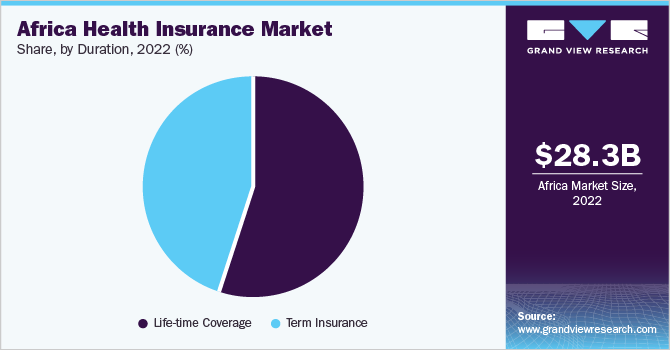

- By duration: The life-time coverage segment dominated the market in 2022, offering long-term benefits that are expected to support segment growth.

Order a free sample PDF of the Africa Health Insurance Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2022 Market Size: USD 28.3 Billion

- 2030 Projected Market Size: USD 50.3 Billion

- CAGR (2023–2030): 5.26%

Key Companies & Market Share Insights

Leading players are focusing on alliances, partnerships, service launches, and geographic expansion to strengthen their positions.

- May 2022: Santam partnered with Allianz to establish the largest pan-African non-banking financial services organization. This collaboration is expected to give clients across Africa access to the combined expertise and resources of both companies.

Key Players

- Santam

- Allianz Care

- Cigna Global

- Aetna International

- Globality Health

- Bupa Global

- Clements Worldwide

- Global Underwriters

- IMG

- Insured Nomads

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The Africa health insurance market is poised for strong growth, driven by rising healthcare costs, increasing use of telemedicine, and supportive regulatory reforms. With innovation from insurers, strategic partnerships, and the adoption of digital solutions, the market is expected to expand coverage and enhance accessibility across the continent.